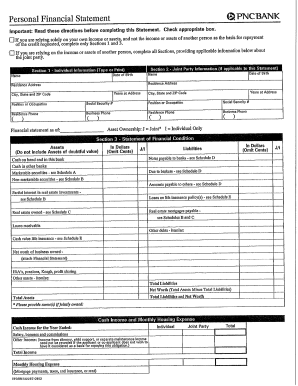

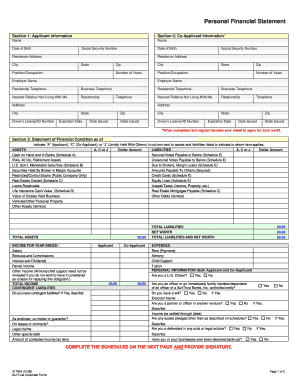

Personal Financial Statement Template - Page 2

What is Personal Financial Statement Template?

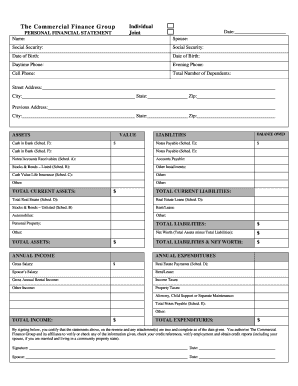

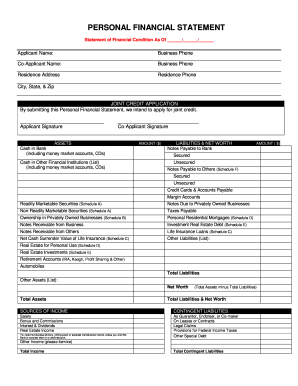

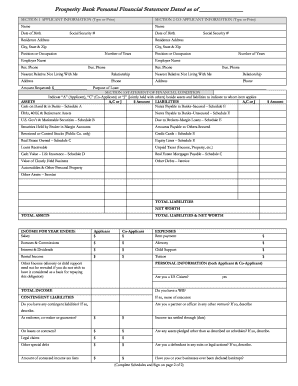

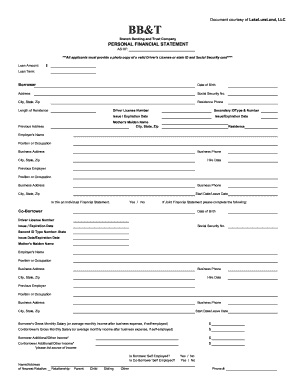

A Personal Financial Statement Template is a document that provides an overview of an individual's financial situation. It includes details about their assets, liabilities, income, and expenses. This template helps individuals assess their financial health and make informed decisions about budgeting, investing, and planning for the future.

What are the types of Personal Financial Statement Template?

There are several types of Personal Financial Statement Templates available:

Balance Sheet: Represents the overall financial position by comparing assets and liabilities.

Cash Flow Statement: Shows the flow of cash in and out of an individual's finances.

Income Statement: Summarizes the income, expenses, and net profit or loss.

Net Worth Statement: Calculates an individual's net worth by subtracting liabilities from assets.

How to complete Personal Financial Statement Template

Completing a Personal Financial Statement Template is a straightforward process. Here are the steps to follow:

01

Gather all necessary financial documents, such as bank statements, investment statements, and loan statements.

02

Record all assets, including cash, real estate, investments, vehicles, and personal belongings, along with their estimated values.

03

List all liabilities, such as mortgages, credit card debts, student loans, and other outstanding loans.

04

Provide details about income sources, including employment wages, rental income, dividends, and any other sources of income.

05

Document all monthly expenses, including housing costs, utilities, transportation expenses, insurance premiums, and other regular expenses.

06

Calculate the net worth by subtracting the total liabilities from the total assets.

07

Review the completed Personal Financial Statement Template and make any necessary revisions or updates.

08

Save the document for future reference or share it with a financial advisor for further analysis.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What should a personal financial statement include?

Common assets include: Account balances: savings, certificates, money market accounts.Common liabilities, however, do include balances for: Credit cards. Student loans. Unpaid medical bills or unpaid taxes. Mortgages or vehicle loans. Loans that you have co-signed.

Does Excel have a personal financial statement template?

The Simple Personal Finance Statement Template for Excel lets you calculate your net worth and present your financial statement when applying for a loan.

How do I write a financial statement?

How to Write a Financial Report? Step 1 – Make a Sales Forecast. Step 2 – Create a Budget for Expenses. Step 3 – Create a Cash Flow Statement. Step 4 – Estimate Net Profit. Step 5 – Manage Assets and Liabilities. Step 6 – Find the Breakeven Point.

Why do you need a personal financial statement?

Why is a personal financial statement useful? This statement is a tool that can be used to analyze your current financial status, enabling you to track net worth and set financial goals. These statements are often reviewed by lenders when a client applies for credit or a loan, including a mortgage.

What are some examples of personal financial documents?

Personal Financial Statement Personal Balance Sheet. Personal Income Statement. Statement of Assets and Liabilities. Net Worth Statement. Net Worth Calculator.

Can I do my own financial statement?

A personal financial statement is a spreadsheet or document that outlines your net worth—which is your assets minus your liabilities. You can create one yourself or employ the help of a financial advisor.

Related templates