Sample Deed Of Trust - Page 2

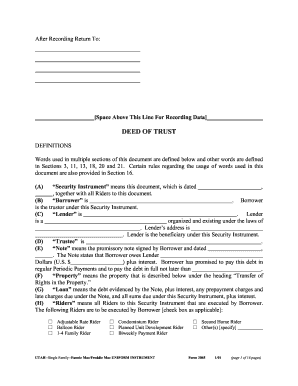

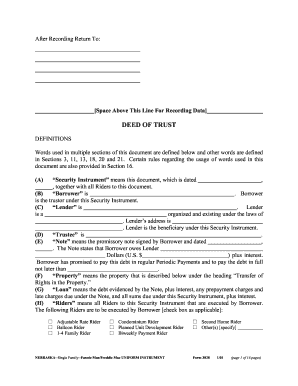

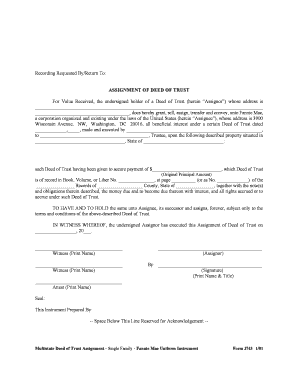

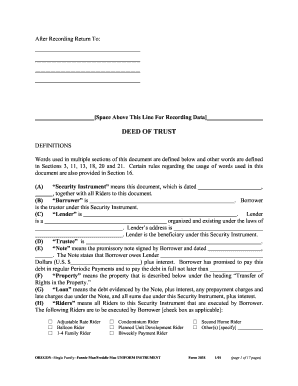

What is Sample Deed Of Trust?

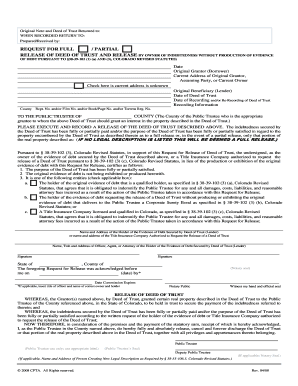

A Sample Deed of Trust is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. It serves as a security for the lender, ensuring that the borrower will repay the loan amount within a specified time frame. In case of default, the lender can use the property listed in the Deed of Trust as collateral to recover the loan.

What are the types of Sample Deed Of Trust?

There are several types of Sample Deed of Trust that can be used depending on the specific situation. Some common types include:

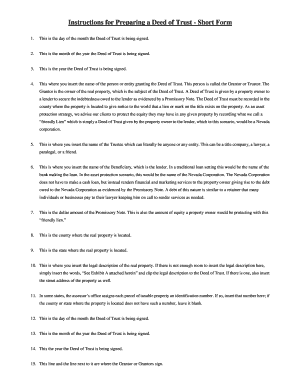

How to complete Sample Deed Of Trust

Completing a Sample Deed of Trust involves a series of steps to ensure that all necessary information is included. Here is a step-by-step guide on how to complete a Sample Deed of Trust:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.