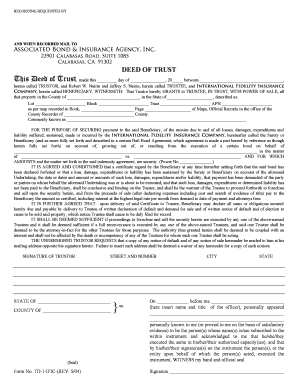

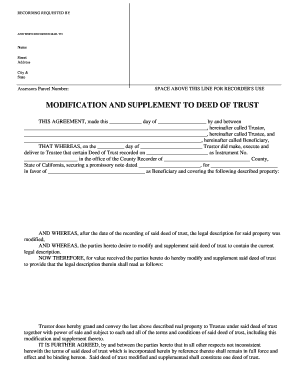

Deed Of Trust Agreement

What is a deed of trust agreement?

A deed of trust agreement is a legal document that transfers the title of a property to a trustee, who holds it as security for a loan between a borrower and a lender. It is commonly used in real estate transactions, where the borrower pledges the property as collateral for the loan.

What are the types of deed of trust agreement?

There are two main types of deed of trust agreement: a trust deed with power of sale and a trust deed without power of sale. In a trust deed with power of sale, the trustee has the authority to sell the property without court involvement in the event of default on the loan. In a trust deed without power of sale, the lender would need to go to court to foreclose on the property.

How to complete a deed of trust agreement

Completing a deed of trust agreement involves several steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.