What is Credit Control List?

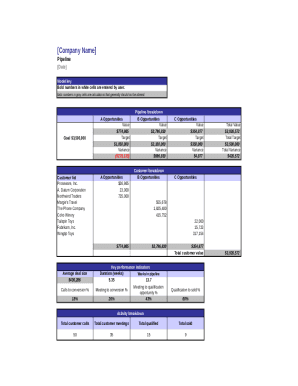

The Credit Control List is a crucial tool used to track and manage a company's outstanding debts. It helps businesses monitor who owes them money and ensures that they follow up on payment deadlines effectively.

What are the types of Credit Control List?

There are mainly two types of Credit Control Lists: 1. Aged Debtors List - This list categorizes outstanding debts based on how long they have been outstanding. It helps prioritize collection efforts. 2. Credit Limit List - This list sets credit limits for customers to manage credit risk and prevent overextension of credit.

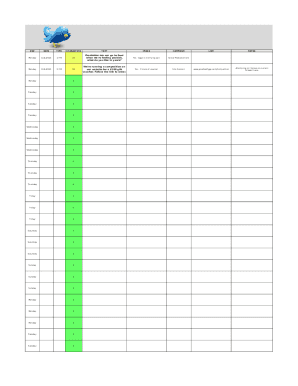

How to complete Credit Control List

Completing a Credit Control List is essential for maintaining financial health. Here are simple steps to help you complete it effectively:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.