What is apply for student loan?

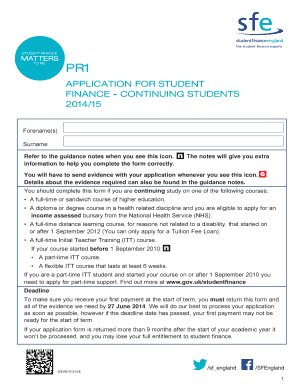

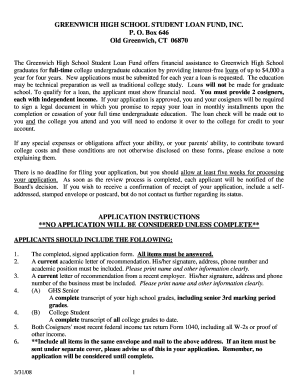

When you apply for a student loan, you are requesting financial assistance to pay for your education. It is a process where you fill out an application and provide necessary documents to prove your eligibility for the loan.

What are the types of apply for student loan?

There are different types of student loans available for you to apply for. Some common types include:

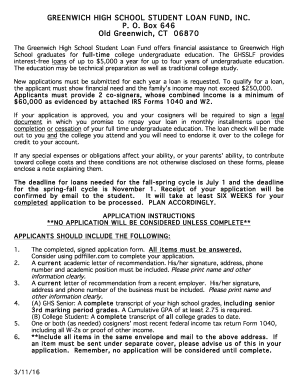

Federal Student Loans: These loans are provided by the government and often have lower interest rates and more flexible repayment options.

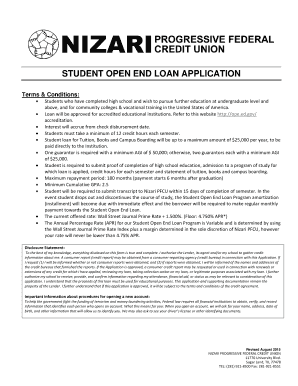

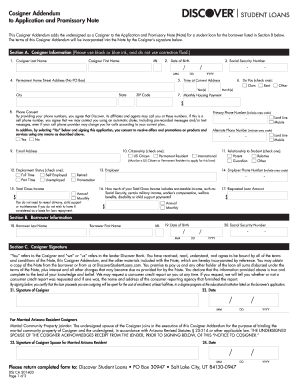

Private Student Loans: These loans are offered by private lenders, such as banks or credit unions. They may have higher interest rates and stricter repayment terms.

Parent PLUS Loans: These loans are available to parents of dependent undergraduate students. They allow parents to borrow money to help pay for their child's education.

Grad PLUS Loans: These loans are available to graduate and professional students. They can help cover the costs of advanced degrees.

Consolidation Loans: These loans allow you to combine multiple student loans into one, simplifying the repayment process.

How to complete apply for student loan

Completing the application for a student loan may seem overwhelming, but with the right guidance, it can be a straightforward process. Here are the steps to complete your student loan application:

01

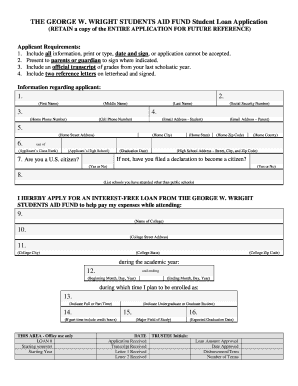

Gather necessary documents: Collect your financial information, such as tax documents, income statements, and identification proofs.

02

Research loan options: Determine which type of loan is best suited for your needs. Consider factors like interest rates, repayment terms, and eligibility requirements.

03

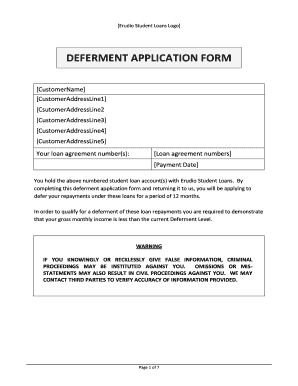

Fill out the application form: Provide accurate and complete information on the application form. Double-check for any errors or omissions.

04

Submit the application: Follow the instructions to submit your application online or by mail. Ensure all required documents are included.

05

Wait for approval: The lender will review your application and make a decision. This process may take some time.

06

Review and sign the loan agreement: If your application is approved, carefully read the loan agreement before signing it. Make sure you understand the terms and conditions.

07

Receive funds: Once the loan agreement is signed, the lender will disburse the funds directly to your school.

08

Manage repayment: After graduation or leaving school, work out a repayment plan with your lender and make timely payments to avoid any penalties or default.

At pdfFiller, we understand how important it is to have a convenient and efficient way to complete your student loan application. That's why we provide a user-friendly platform that empowers you to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and accurately.