What is direct loans?

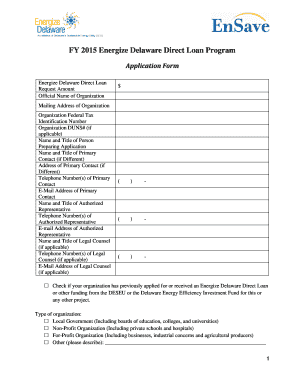

Direct loans are loans that a borrower receives directly from the federal government, typically through the Department of Education. These loans are different from loans obtained through private lenders such as banks and credit unions. Direct loans offer several benefits including fixed interest rates, flexible repayment options, and the possibility of loan forgiveness.

What are the types of direct loans?

There are several types of direct loans available to borrowers. These include:

Direct Subsidized Loans: These loans are available to undergraduate students with demonstrated financial need. The government pays the interest on these loans while the borrower is in school, during the grace period, and during deferment periods.

Direct Unsubsidized Loans: These loans are available to undergraduate and graduate students. Unlike subsidized loans, borrowers are responsible for paying the interest on these loans throughout the life of the loan.

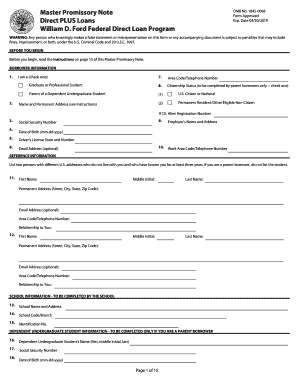

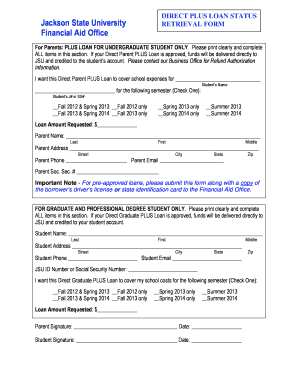

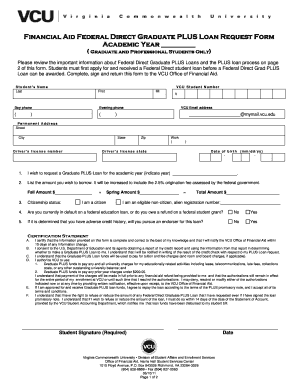

Direct PLUS Loans: These loans are available to graduate students and parents of dependent undergraduate students. They require a credit check and offer flexible repayment options.

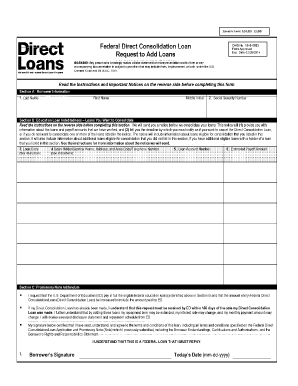

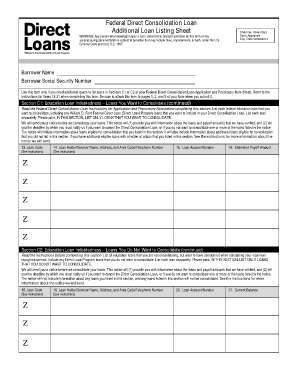

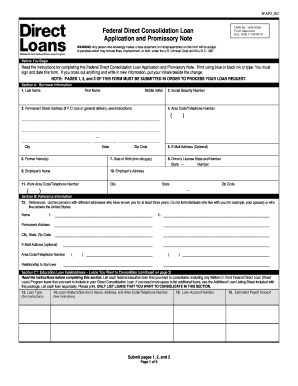

Direct Consolidation Loans: These loans allow borrowers to combine multiple federal education loans into one loan, simplifying repayment.

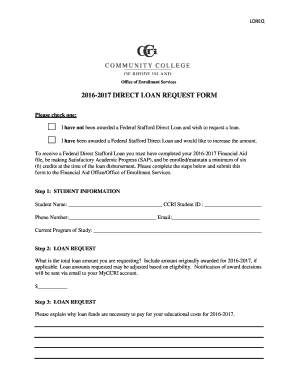

How to complete direct loans

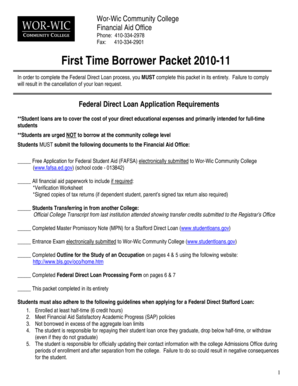

Completing direct loan applications can seem overwhelming, but breaking down the process into steps can make it more manageable. Here is a step-by-step guide to help you complete your direct loan application:

01

Gather the necessary documents and information, such as your Social Security number, driver's license, and financial information.

02

Fill out the Free Application for Federal Student Aid (FAFSA). This form determines your eligibility for federal student aid, including direct loans.

03

Review your Student Aid Report (SAR) and make any necessary corrections.

04

Accept or decline your loan offer through your school's financial aid office.

05

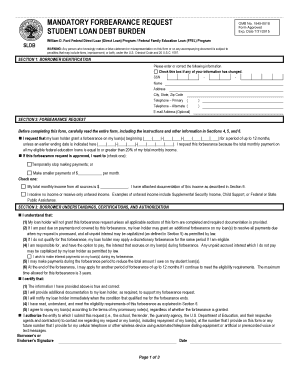

Complete entrance counseling, which provides you with important information about your rights and responsibilities as a borrower.

06

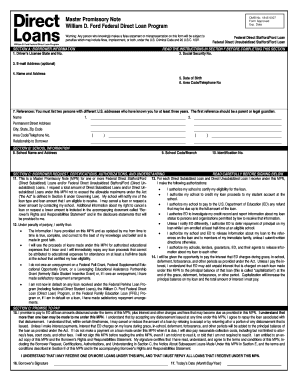

Sign a Master Promissory Note (MPN), which is a legal document stating that you promise to repay your loans and any accrued interest.

07

Monitor your loan disbursement and keep track of your loan servicer for future communication and repayment.

08

Make sure to stay informed about loan repayment options and resources available to you.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.