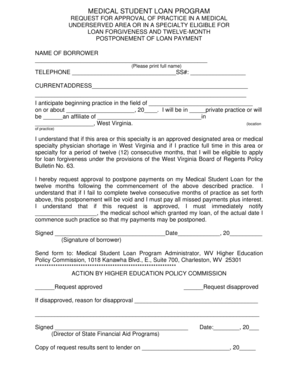

What is student loans forgiveness?

Student loan forgiveness is a government program that relieves borrowers from the obligation of repaying their student loans. It is designed to help individuals who are struggling to make their loan payments due to financial hardship or other circumstances. This program allows eligible borrowers to have a portion or all of their student loans forgiven, depending on the specific forgiveness program they qualify for.

What are the types of student loans forgiveness?

There are several types of student loan forgiveness programs available, each catering to different borrowers and loan types. Some of the common types of student loan forgiveness include:

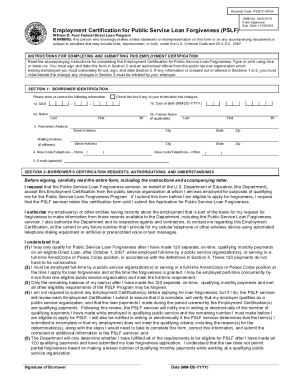

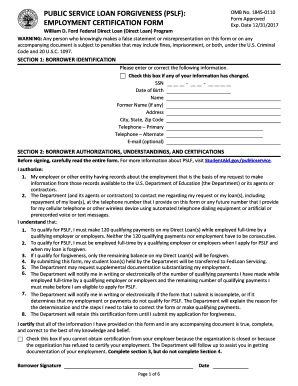

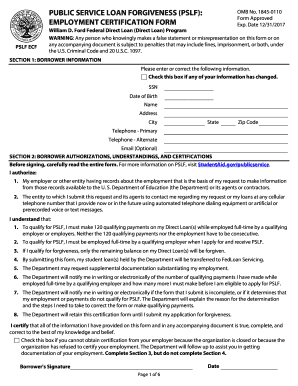

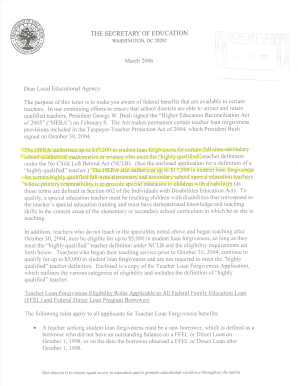

Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance on eligible Direct Loans after the borrower has made 120 qualifying payments while working full-time for a qualifying employer in the public service sector.

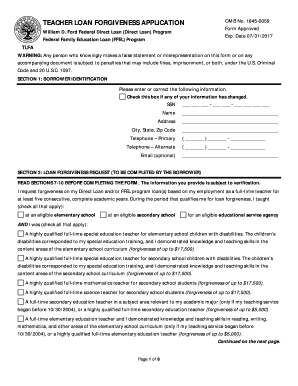

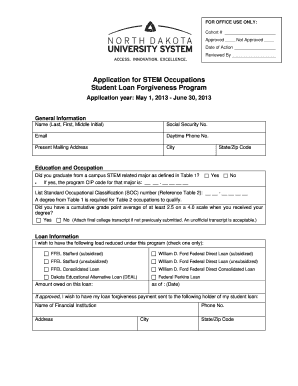

Teacher Loan Forgiveness: This program is available for teachers who have been employed full-time for five consecutive years in a low-income school or educational service agency. It offers forgiveness of up to $17,500 on eligible federal student loans.

Income-Driven Repayment Plan Forgiveness: Borrowers who enroll in an income-driven repayment plan and make payments for a designated period of time may be eligible for forgiveness of the remaining loan balance.

Perkins Loan Cancellation: Borrowers who work in certain public service sectors, such as teaching, nursing, or law enforcement, may qualify for cancellation of their Perkins Loans.

Closed School Discharge: If a borrower's school closes while they are enrolled or shortly after they withdraw, they may be eligible for a discharge of their federal student loans.

Total and Permanent Disability Discharge: Borrowers who have a total and permanent disability may qualify for a discharge of their federal student loans.

How to complete student loans forgiveness

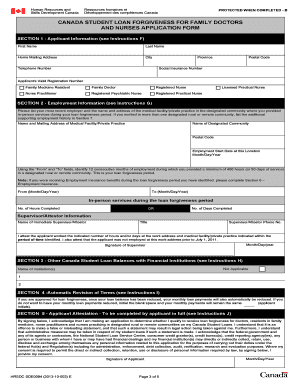

Completing the student loan forgiveness process requires understanding the specific requirements of the forgiveness program you qualify for. Here are the general steps to follow:

01

Research and identify the student loan forgiveness programs available for your loan type and circumstances.

02

Gather all necessary documentation and information required for the application process, such as loan information, employment records, and income documentation.

03

Review and fill out the forgiveness application accurately and completely.

04

Submit the completed application along with any required supporting documents to the appropriate loan servicer or forgiveness program administrator.

05

Track the progress of your forgiveness application and follow up with any additional information or documentation requested.

06

If approved, continue making qualifying payments or meet the program requirements until the forgiveness is granted.

07

Maintain accurate records of all communications, payments, and documents related to the student loan forgiveness process.

pdfFiller is an essential tool for those seeking student loan forgiveness. With its user-friendly interface and powerful features, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.