College Budget

What is College Budget?

A college budget is a plan that helps students manage their finances effectively during their time in college. It serves as a guide for allocating funds for various expenses such as tuition fees, textbooks, housing, meals, transportation, and personal needs.

What are the types of College Budget?

There are several types of college budgets that students can utilize based on their individual circumstances. The most common types include:

Fixed Budget: This type of budget involves setting a specific amount for each expense category and sticking to it. It helps students prioritize their spending and avoid unnecessary expenses.

Flexible Budget: A flexible budget allows for adjustments in spending depending on changing circumstances. It provides more freedom and adaptability for unexpected expenses that may arise during the year.

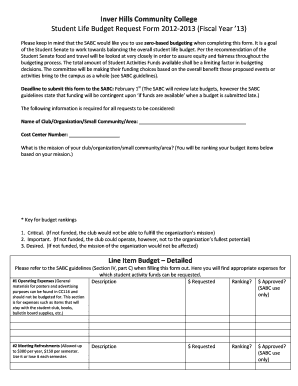

Zero-Based Budget: With a zero-based budget, students allocate every dollar of their income towards a particular purpose. This budgeting method requires careful planning and tracking of expenses.

Envelope Method: The envelope method involves dividing cash into envelopes labeled with different expense categories. Students can only spend from the designated envelope, helping them stay within their budget.

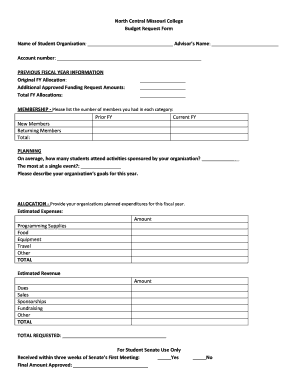

How to complete College Budget?

Completing a college budget can be done in several steps:

01

Determine Income: Calculate all sources of income, such as scholarships, part-time jobs, or financial aid. This will provide a clear picture of the available funds.

02

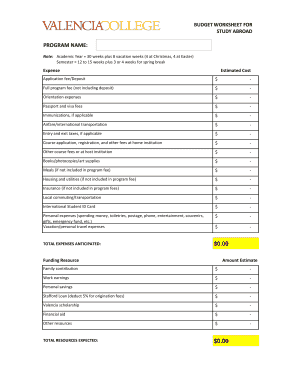

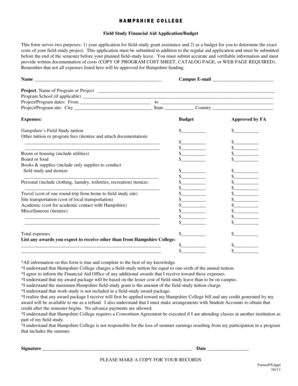

Identify Expenses: Make a list of all expenses, including tuition fees, housing costs, transportation, meals, books, and other personal needs. Be thorough to ensure nothing is overlooked.

03

Prioritize and Allocate: Prioritize essential expenses and allocate funds accordingly. Consider adjusting expenses based on importance and available resources.

04

Track Spending: Monitor expenses regularly and keep track of how much is being spent in each category. This helps identify areas where adjustments may be needed.

05

Review and Adjust: Regularly review the budget to ensure it aligns with the actual spending. Make adjustments as necessary to stay on track and meet financial goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write a college budget?

How to create a budget while in college Calculate your net income. List monthly expenses. Organize your expenses into fixed and variable categories. Determine average monthly costs for each expense. Make adjustments.

How much spending money does a college student need per week?

Some students were given money when expenses arose rather than as a proscribed regular weekly amount. The consensus among the hundreds of parents who did send their college students spending money was that the range should be between $25-$75 a week for a student living on campus.

What are the 5 main expenses for college?

School Expenses Tuition & Fees. College tuition and fees are the greatest costs of attending college. Books & Supplies. Look into options for buying used books or renting books. Housing/Rent. Most schools offer various options of on-campus housing and dorm rooms. Food. Transportation. Entertainment. Other Expenses.

What should I budget for in college?

Sample Budget for a College Student Per MonthPer Academic YearLaundry$0$0Groceries/Meal Plan$150$1,350Car Payment$150$1,350Car Insurance and Registration$200$1,80013 more rows

What items should you budget for in college?

To determine what you'll spend each term, keep these college-related expenses on your radar: Textbooks and school supplies. Course materials could eat up a large chunk of your budget. Room and board. When it comes to food and living arrangements, weigh your options. Transportation. Clothing. Discretionary spending.

How do you create a simple budget plan?

The following steps can help you create a budget. Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.