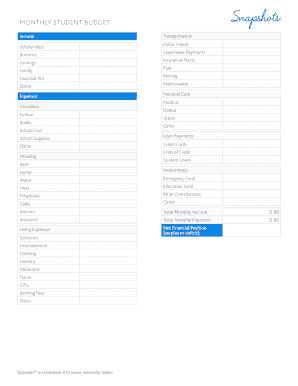

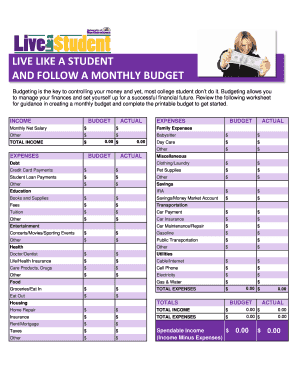

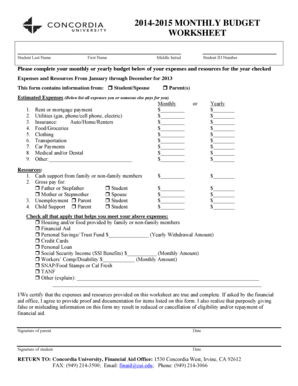

What is college student monthly budget?

A college student monthly budget is a financial plan that helps students track and manage their income and expenses on a monthly basis. It is crucial for students to have a budget to ensure they are able to cover their expenses and avoid unnecessary debts. By creating a monthly budget, college students can effectively manage their money and make informed financial decisions.

What are the types of college student monthly budget?

There are several types of college student monthly budgets that students can choose based on their preferences and financial goals. Some common types include:

Fixed Budget: This type of budget allocates a fixed amount of money towards each expense category. It helps students plan and control their spending while ensuring they meet their financial obligations.

Flexible Budget: A flexible budget allows students to adjust their spending based on their income and unexpected expenses. It provides more flexibility but requires regular monitoring and adjustment.

Zero-Based Budget: This budgeting method requires students to allocate every dollar of their income towards specific expenses, savings, or investments. It helps prioritize financial goals and encourages efficient use of income.

Envelope System: The envelope system involves dividing cash into different envelopes for each expense category. This helps students visually track their spending and avoid overspending in specific categories.

Percentage-Based Budget: This budgeting method allocates a certain percentage of the student's income towards different expense categories. It provides flexibility while ensuring important financial goals are covered.

How to complete college student monthly budget

Completing a college student monthly budget requires a systematic approach. Here are the steps to follow:

01

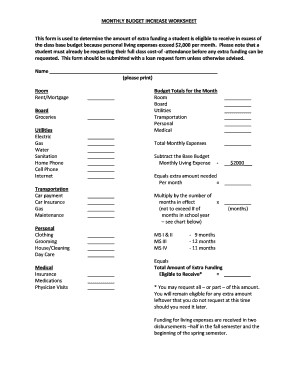

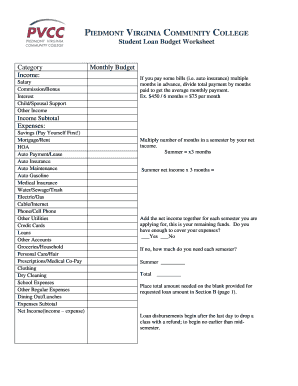

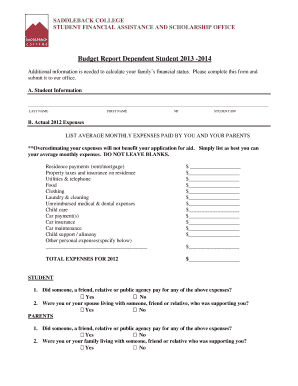

Track your income and expenses: Start by calculating your monthly income from all sources, such as part-time jobs or financial aid. Then, track your expenses for the month, including rent, food, transportation, textbooks, and other essentials.

02

Categorize your expenses: Divide your expenses into categories such as housing, utilities, groceries, transportation, entertainment, and savings. This will help you understand where your money is going and identify areas where you can cut back.

03

Set financial goals: Determine your financial goals, whether it's saving for emergencies, paying off student loans, or planning for future expenses. Set specific goals and allocate funds accordingly.

04

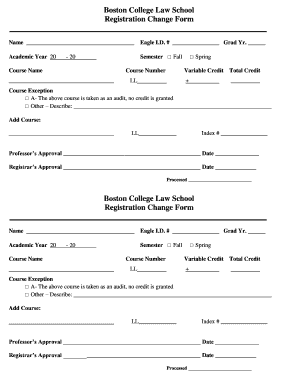

Create a budget plan: Based on your income, expenses, and financial goals, create a budget plan that ensures all your expenses are covered and leaves room for savings. Use budgeting apps or tools to simplify the process.

05

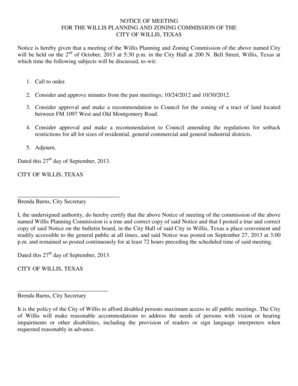

Monitor and adjust: Regularly monitor your budget and track your spending. Make adjustments as needed to stay on track and achieve your financial goals.

06

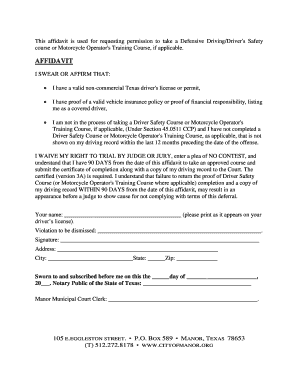

Consider additional resources: Explore resources like pdfFiller that empower users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller can assist you in managing your financial documents effectively.

By following these steps and utilizing helpful resources like pdfFiller, you can successfully complete your college student monthly budget and take control of your financial situation.