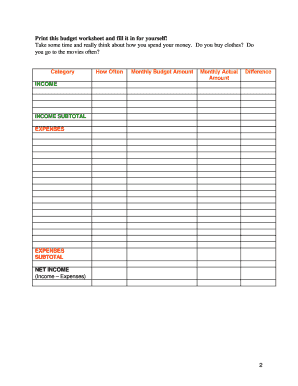

Sample Student Budget Worksheet

What is sample student budget worksheet?

A sample student budget worksheet is a tool used to track and manage expenses for students. It helps students organize their income, expenses, and savings goals. This worksheet provides a clear picture of where the student's money is coming from and where it is going, allowing them to make informed financial decisions.

What are the types of sample student budget worksheet?

There are several types of sample student budget worksheets available. Some common types include:

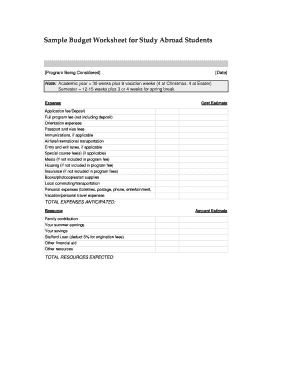

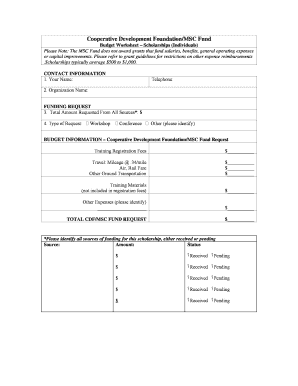

Basic student budget worksheet: This type of worksheet includes sections for income, expenses, and savings goals. It provides a simple and straightforward way to track and manage finances.

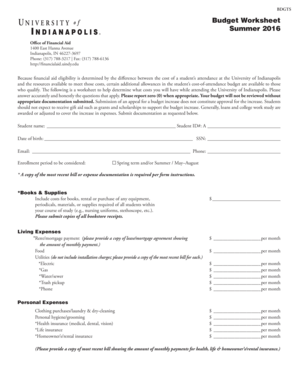

Detailed student budget worksheet: This type of worksheet includes additional sections for categorizing expenses, such as rent, groceries, transportation, and entertainment. It offers a more comprehensive view of the student's financial situation.

Monthly student budget worksheet: This type of worksheet focuses on a monthly budget and helps students plan their expenses and savings on a monthly basis.

Annual student budget worksheet: This type of worksheet helps students set and track their financial goals for the entire year. It allows them to plan ahead and make long-term financial decisions.

College-specific student budget worksheet: Some universities and colleges provide their own budget worksheets tailored to their students' needs and expenses. These worksheets often include specific categories and sections relevant to college expenses, such as tuition fees, textbooks, and housing.

How to complete sample student budget worksheet

Completing a sample student budget worksheet is a simple process. Follow these steps:

01

Gather all necessary financial information: Collect information about your income sources, such as part-time jobs, scholarships, or allowances. Also, gather information about your expenses, including rent, groceries, transportation, and other bills.

02

Determine your financial goals: Set clear financial goals, such as saving a certain amount each month or reducing expenses in specific areas.

03

Fill in the income section: Record all your sources of income in the designated section of the worksheet. Make sure to include the amounts and frequency of each income source.

04

Fill in the expense section: Categorize your expenses and record them in the worksheet. Be detailed and include all regular expenses, as well as occasional or unexpected ones.

05

Calculate the difference: Deduct your total expenses from your total income to determine the difference. This will show whether you have a surplus or a deficit in your budget.

06

Adjust your budget if needed: If you have a deficit, look for areas where you can cut expenses or increase your income. If you have a surplus, consider saving or investing the extra money.

07

Review and track your budget regularly: Regularly review your budget and track your expenses to ensure you are staying on track and making progress towards your financial goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the 4 steps in planning a budget?

The four phases of a budget cycle for small businesses are preparation, approval, execution and evaluation. A budget cycle is the life of a budget from creation or preparation, to evaluation.

What are the steps in preparing a budget worksheet?

Creating a budget Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

What are the 7 steps to planning a budget?

How to make a budget in 7 steps Figure out your income. Start by making a list of all the money you have coming in each month. Map out your expenses. Figure out where your money is going by making a list of your expenses each month. Calculate your balance. Identify your goals. Make a plan. Stay on track. Talk to an expert.

How do I create a student budget in Excel?

How to Create a College-Style Budget Using Excel Step 1: Basic Functions of Excel Video. Step 2: Create Title. Step 3: Create Column Headings. Step 4: Create Row Headings for Income. Step 5: Create Row Headings. Step 6: Create Row Heading for Net Income. Step 7: Fill Income Categories. Step 8: Fill Expense Categories.

Is there a budget spreadsheet in Excel?

Creating a budgeting plan for your household can feel overwhelming and hard, but Excel can help you get organized and on track with a variety of free and premium budgeting templates.

How do you write a financial plan for a student?

Here's how to make a financial plan in seven steps, regardless of your income level: Start with goal setting. Review your finances. Eliminate high APR debt. Build an emergency fund. Invest in your future. Build “sinking funds” Reduce your liabilities.

Related templates