What is a typical college student budget?

A typical college student budget refers to the amount of money that a student expects to spend on various expenses during their time in college. This budget usually includes costs such as tuition fees, accommodation, textbooks, transportation, food, and other miscellaneous expenses.

What are the types of a typical college student budget?

There are several types of typical college student budgets, depending on individual circumstances and financial situations. Some common types include:

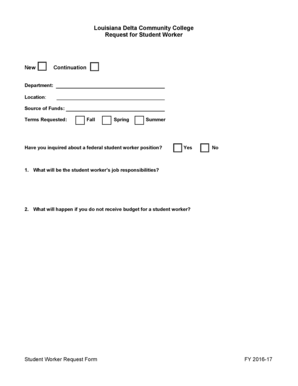

Full-time Student Budget: This budget is designed for students who are enrolled full-time and includes all necessary expenses for attending college.

Part-time Student Budget: This budget is tailored for students who are enrolled part-time and may have different financial considerations.

Commuter Student Budget: This budget is suitable for students who live off-campus and commute to college for classes.

Residential Student Budget: This budget is designed for students who live on-campus and includes expenses such as housing and meal plans.

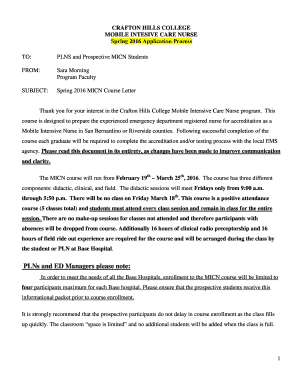

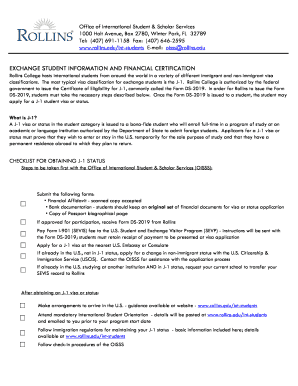

International Student Budget: This budget is specifically created for international students and takes into account additional expenses like visa fees and travel costs.

How to complete a typical college student budget

Completing a typical college student budget is essential for managing your finances effectively. Here are some steps to help you complete your budget:

01

Calculate your income: Determine the amount of money you have available from sources such as scholarships, grants, part-time jobs, and family contributions.

02

List your expenses: Make a comprehensive list of all your expected expenses, including tuition fees, accommodation, textbooks, transportation, food, and personal expenses.

03

Estimate costs: Research and estimate the cost of each expense item to get an accurate idea of how much you will need to allocate for each category.

04

Set priorities: Prioritize your expenses based on their importance and allocate funds accordingly. Focus on essential items like tuition and accommodation first.

05

Track your spending: Monitor your expenses regularly and make adjustments as necessary to stay within your budget.

06

Seek financial aid: Explore opportunities for scholarships, grants, and student loans to help alleviate the financial burden of college.

07

Review and update regularly: Review your budget periodically and update it as needed to reflect any changes in your financial situation or expenses.

By following these steps, you can create a comprehensive and realistic college student budget that will help you manage your finances efficiently. Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.