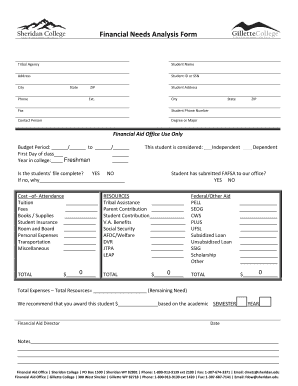

What is college budget plan template?

A college budget plan template is a tool that helps college students track and manage their expenses. It provides a structured format for recording income, fixed expenses, variable expenses, and savings. With a college budget plan template, students can have a clear overview of their financial situation and make informed decisions about their spending.

What are the types of college budget plan template?

There are various types of college budget plan templates available, catering to different needs and preferences. Some common types of templates include:

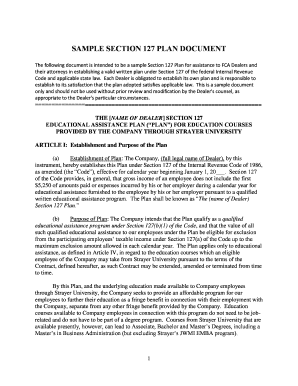

Basic budget plan template: This template includes general categories for income, expenses, and savings.

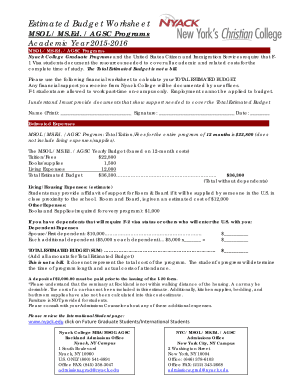

Detailed budget plan template: This template provides more specific categories for different types of expenses, such as tuition fees, textbooks, housing, transportation, and entertainment.

Monthly budget plan template: This template focuses on monthly expenses and helps students plan their budget on a month-to-month basis.

Annual budget plan template: This template helps students plan their budget for the entire academic year, taking into account both fixed and variable expenses.

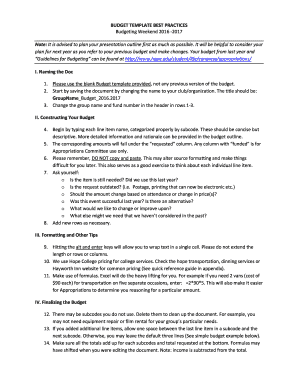

How to complete college budget plan template

Completing a college budget plan template is an easy and straightforward process. Here are the steps to follow:

01

Gather information about your income: This includes any allowances, part-time jobs, scholarships, or grants that you receive.

02

List your fixed expenses: These are expenses that remain constant each month, such as tuition fees, rent, or loan payments.

03

Track your variable expenses: These expenses can vary from month to month, such as groceries, transportation, or entertainment.

04

Allocate funds for savings: It's important to set aside a portion of your income for savings or emergencies.

05

Review and adjust your budget regularly: As your income or expenses may change, it's essential to review and adjust your budget accordingly.

06

Utilize pdfFiller: pdfFiller empowers users to create, edit, and share documents online, including college budget plan templates. With unlimited fillable templates and powerful editing tools, pdfFiller is the perfect PDF editor to help you get your documents done efficiently and effectively.

By following these steps and utilizing a college budget plan template, you can take control of your finances and make the most out of your college experience.