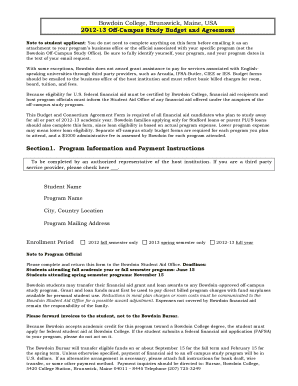

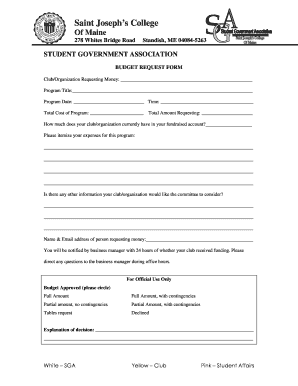

What is college student budget example?

A college student budget example refers to a sample budget plan specifically designed for students who are attending college. It helps students manage their finances effectively and ensure that they have enough money for their essential expenses while still being able to save and have some extra cash.

What are the types of college student budget example?

There are several types of college student budget examples that cater to different financial situations and goals. The most common types include:

Basic Budget: This type focuses on the essential expenses such as tuition fees, rent, utilities, groceries, and transportation.

Frugal Budget: Designed for students who want to minimize their expenses and save as much as possible. It includes strategies like cooking meals at home, using public transportation, and finding affordable alternatives for entertainment.

Part-Time Job Budget: This type incorporates income from part-time jobs into the budget plan. It helps students manage their earnings and expenses while balancing their academic commitments.

Summer Job Budget: Specifically for students who work during the summer break, this budget focuses on allocating income earned during this period to cover expenses throughout the year.

Debt Repayment Budget: For students who have loans or credit card debts, this budget helps allocate funds towards paying off those debts while managing other expenses.

How to complete college student budget example

Completing a college student budget example is a straightforward process. Here are the steps you can follow:

01

Determine your income: Calculate the total amount of money you receive regularly from sources such as scholarships, grants, part-time jobs, or financial aid.

02

Identify your expenses: Make a list of all your expenses, including tuition fees, accommodation, textbooks, transportation, groceries, dining out, entertainment, and any other recurring costs.

03

Categorize your expenses: Group your expenses into essential and non-essential categories to prioritize your spending.

04

Set realistic goals: Decide how much money you want to allocate for savings, emergencies, and discretionary spending.

05

Create a budget plan: Use a spreadsheet or budgeting app to allocate your income to various expense categories. Adjust the amounts as necessary to ensure you stay within your means.

06

Track your spending: Regularly monitor your expenses and compare them to your budget. This will help you identify areas where you can cut back or make adjustments.

07

Review and make changes: Periodically review your budget and make necessary changes to accommodate any changes in your income or expenses.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.