What is fbar filing instructions?

Fbar filing instructions refer to the guidelines provided by the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of Treasury for reporting foreign financial accounts. These instructions outline the requirements and procedures for individuals to file their Foreign Bank and Financial Accounts Report (FBAR) to ensure compliance with the Bank Secrecy Act (BSA). By following these instructions, individuals can properly report their foreign financial accounts and avoid any penalties or legal issues.

What are the types of fbar filing instructions?

The types of fbar filing instructions vary based on the specific reporting requirements and circumstances of the individual. Some common types of fbar filing instructions include:

Determining if an FBAR filing is necessary

Identifying reportable foreign financial accounts

Record-keeping requirements for FBAR filings

Reporting joint accounts or accounts with signature authority

Understanding exemptions and exceptions to FBAR reporting

How to complete fbar filing instructions

Completing fbar filing instructions requires careful attention to detail and adherence to the provided guidelines. Here is a step-by-step process to help you complete the fbar filing instructions:

01

Gather all necessary information: Collect information about your foreign financial accounts, including their names, addresses, account numbers, and maximum values during the reporting year.

02

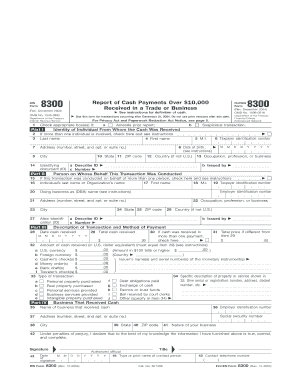

Determine if an FBAR filing is required: Review the criteria for filing an FBAR to determine whether you meet the reporting threshold. If your aggregate foreign financial accounts exceeded $10,000 at any time during the year, you are generally required to file.

03

Use the appropriate form: The FBAR is filed electronically using FinCEN Form 114, which can be accessed on the official FinCEN website.

04

Complete the form accurately: Provide all required information on the form, including personal details, account information, and the maximum values of your accounts.

05

Submit the form: Once you have completed the form, submit it electronically through the FinCEN BSA E-Filing System. Make sure to keep a copy of the submitted form for your records.

06

Keep track of filing deadlines: FBAR filings are due on April 15th of the following calendar year. Ensure you submit your form before the deadline to avoid any penalties.

In conclusion, pdfFiller empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor users need to efficiently complete their fbar filing instructions.