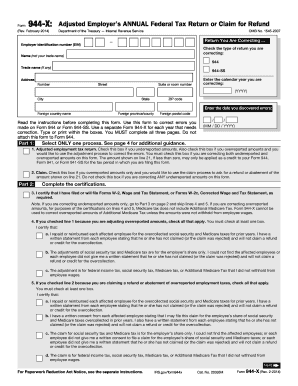

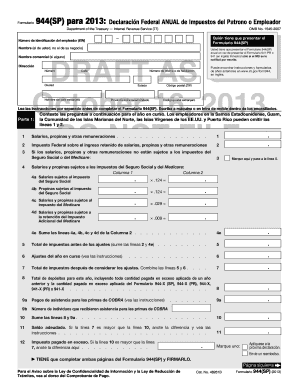

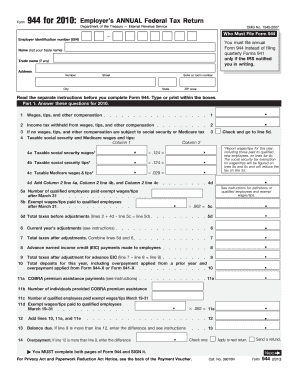

Form 944 For 2012 - Page 2

What is Form 944 For 2012?

Form 944 for 2012 is a tax form used by small businesses to report their annual federal employment tax returns. It is specifically designed for employers whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less.

What are the types of Form 944 For 2012?

The types of Form 944 for 2012 include:

Form 944 - Employer's Annual Federal Tax Return

Form 944 (Schedule R) - Allocation Schedule for Aggregate Form 941 Filers

How to complete Form 944 For 2012

To complete Form 944 for 2012, follow these steps:

01

Gather all necessary information such as employer identification number, total number of employees, and total wages paid.

02

Fill out the form accurately, ensuring all information is correct.

03

Review the form for any errors before submitting it to the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Form 944 For 2012

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is Form 944 filed annually?

More In Forms and Instructions Form 944 is designed so the smallest employers (those whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less) will file and pay these taxes only once a year instead of every quarter.

How do I file IRS Form 944?

To file Form 944 for calendar year 2022, you must call the IRS at 800-829-4933 (267-941-1000 (toll call) if you're outside the United States) between January 1, 2022, and April 1, 2022, or send a written request postmarked between January 1, 2022, and March 15, 2022.

Does an LLC have to file Form 944?

Any LLC with employees will also need to file Form 940, which is the Employer's Annual Federal Unemployment (FUTA) Tax Return and Form 941, which is the Employer's Quarterly Federal Tax Return, or Form 944, the Employer's Annual Federal Tax Return.

How do I request a 944 form?

You can request to file Form 944. Either call the IRS at (800-829-4933) or send a written request. If the IRS accepts your request, they will contact you.

Where do I file my 944?

Mailing Addresses for Forms 944 Mail return without payment Mail return with payment Internal Revenue Service P.O. Box 409101 Ogden, UT 84409Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-21003 more rows • Aug 22, 2022

How much does it cost to file a Form 944?

File 944 Online # of Forms1-10101-500Pricing Tier$4.99/form$1.99/form