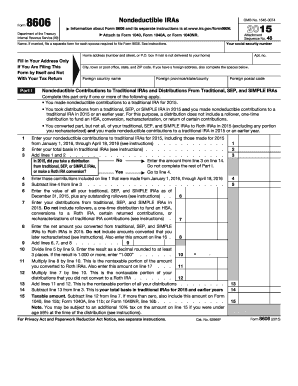

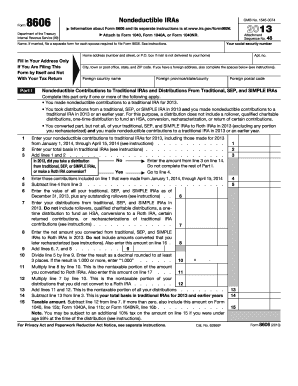

8606 Form

What is 8606 Form?

The 8606 Form is a tax form used by individuals to report certain transactions related to non-deductible contributions made to traditional IRAs, Roth IRAs, or Qualified Retirement Plans.

What are the types of 8606 Form?

There are two types of 8606 Form:

8606 Form for reporting non-deductible contributions to traditional IRAs

8606 Form for reporting distributions from Roth IRAs

How to complete 8606 Form

Completing the 8606 Form is a straightforward process. Here are the steps to follow:

01

Gather all the necessary information and documents, including your IRA account statements and contribution records.

02

Fill out the personal information section, including your name, social security number, and address.

03

Provide the details of your IRA contributions or distributions, depending on the type of 8606 Form you are completing.

04

Calculate the taxable amount and enter it in the appropriate section.

05

Double-check all the information for accuracy and completeness.

06

Sign and date the form before submitting it to the appropriate tax authority.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 8606 Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you file form 8606?

If you aren't required to file an income tax return but are required to file Form 8606, sign Form 8606 and send it to the IRS at the same time and place you would otherwise file Form 1040, 1040-SR, or 1040-NR. Be sure to include your address on page 1 of the form and your signature and the date on page 2 of the form.

Can I File 8606 Electronically?

Can IRS Form 8606 Be E-Filed? You can e-file Form 8606 with the rest of your annual tax return when you e-file your 1040 and any other tax forms, along with any payments due.

What does the IRS do with form 8606?

Use Form 8606 to report: Nondeductible contributions you made to traditional IRAs. Distributions from traditional, SEP, or SIMPLE IRAs, if you have ever made nondeductible contributions to traditional IRAs. Conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs.

What happens if I don't report my IRA contributions?

If you do nothing, the IRS will treat your contributions as though they were deductible, and tax them when you make withdrawals at retirement. You can file IRS Form 8606 to declare your IRA contributions as nondeductible, and take withdrawals tax-free later.

How far back can you file form 8606?

The penalty for late filing a Form 8606 is $50. There is no time limit for the amended/late filing. However, if a filing omission resulted in an immediate tax consequence (like the full taxation of a Roth conversion), the amendment must be made prior to the three-year limitation on refunds.

What happens if you don't file form 8606?

Failure to file Form 8606 for a distribution could result in the IRA owner (or beneficiary) paying income tax and the additional 10 percent early distribution penalty tax on amounts that should be tax-free.