Irs E File Extension - Page 2

What is irs e file extension?

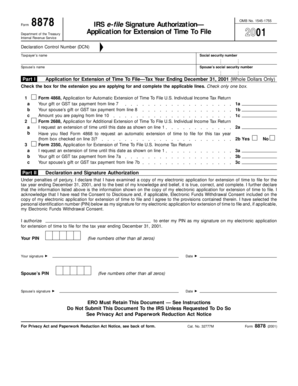

The IRS e-file extension is a file extension used by the Internal Revenue Service (IRS) for electronically filing tax returns. This extension allows taxpayers to submit their tax returns online, eliminating the need for paper forms and manual processing. By using the IRS e-file extension, taxpayers can receive faster refunds and avoid errors commonly associated with paper filing.

What are the types of irs e file extension?

The IRS offers different types of e-file extensions to cater to different types of tax returns. The most common types of IRS e-file extensions include:

How to complete irs e file extension

Completing the IRS e-file extension is a straightforward process. Here are the steps to follow:

By following these steps, you can easily complete the IRS e-file extension process and ensure that your tax return is submitted on time.