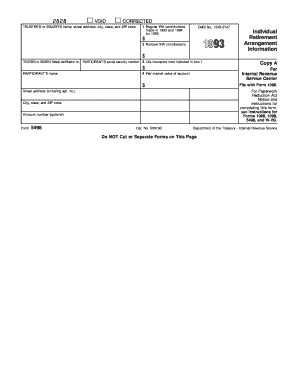

Irs Form 5498 - Page 2

What is Irs Form 5498?

IRS Form 5498 is a document used for reporting contributions made to an individual retirement arrangement (IRA). It provides important information about the amounts contributed to an IRA during a tax year. This form is used by both the account holders and the IRS to determine the tax obligations and eligibility for certain tax benefits.

What are the types of Irs Form 5498?

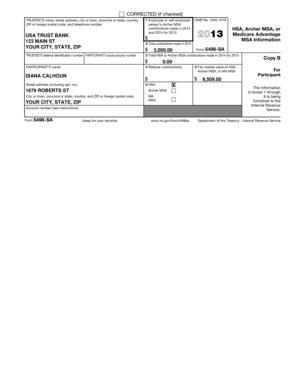

There are three main types of IRS Form 5498: 1. Form 5498-IRA: This form is used to report contributions made to a traditional, Roth, or simplified employee pension (SEP) IRA. 2. Form 5498-SA: This form is used to report contributions made to a health savings account (HSA). 3. Form 5498-ESA: This form is used to report contributions made to a Coverdell Education Savings Account (ESA).

How to complete Irs Form 5498

Completing IRS Form 5498 is fairly straightforward. Here are the steps to follow: 1. Gather the necessary information: You will need the account holder's name, address, social security number, and the name of the financial institution where the IRA, HSA, or ESA is held. 2. Enter the contribution amounts: Fill in the appropriate sections with the contributions made during the tax year for each type of account. 3. Verify accuracy: Double-check all the information entered to ensure its accuracy. 4. Submit the form: Once completed, submit the form to the IRS and keep a copy for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.