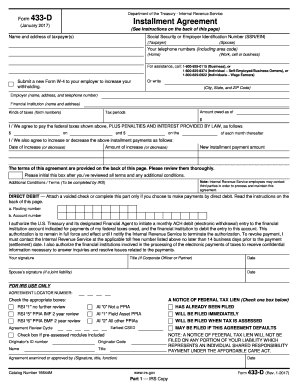

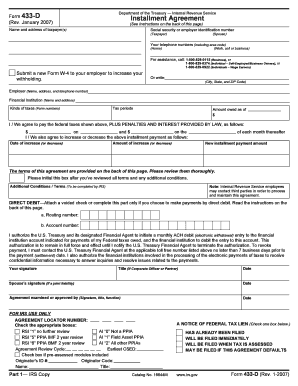

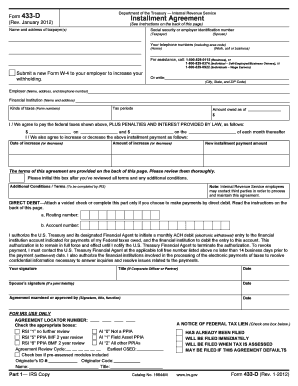

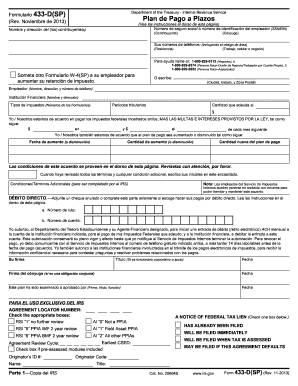

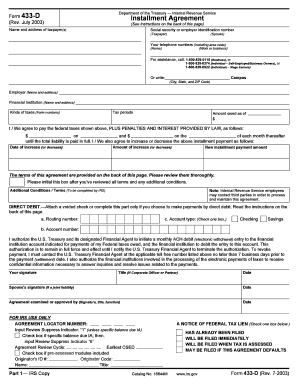

Irs Installment Agreement Form 433-d

What is irs installment agreement form 433-d?

The irs installment agreement form 433-d is a document that individuals can use to request a monthly payment plan when they are unable to pay their tax bill in full. This form is specifically for taxpayers who owe $50,000 or less in combined tax, penalties, and interest.

What are the types of irs installment agreement form 433-d?

There are two main types of irs installment agreements that can be requested using form 433-d: 1. Guaranteed Installment Agreement: This type of agreement is available if you owe $10,000 or less and meet certain criteria. The IRS is required to approve this agreement as long as you meet the eligibility requirements. 2. Streamlined Installment Agreement: This type of agreement is available if you owe between $10,000 and $50,000. While the IRS still needs to review your financial information, this agreement is generally easier to qualify for than other types.

How to complete irs installment agreement form 433-d

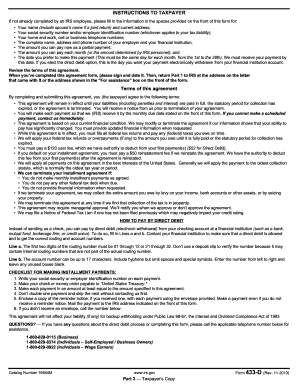

Completing the irs installment agreement form 433-d is a simple process. Here are the steps you need to follow: 1. Download the form from the official IRS website. 2. Fill in your personal information, including your name, address, social security number, and phone number. 3. Provide details about your financial situation, including your monthly income and expenses. 4. Indicate the installment agreement type you are requesting. 5. Sign and date the form. 6. Send the completed form to the IRS using the address provided on the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.