Probate Forms

What are Probate Forms?

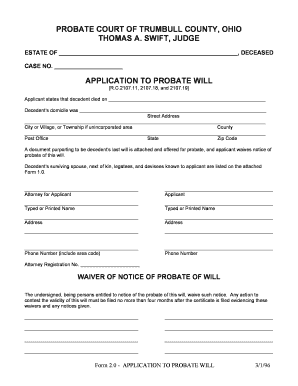

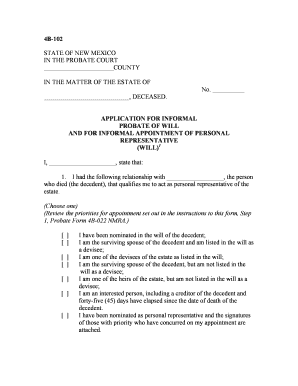

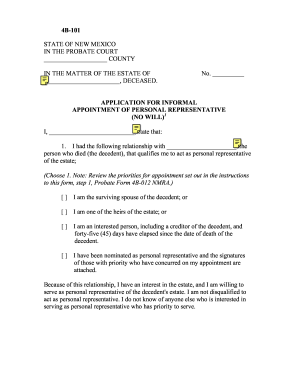

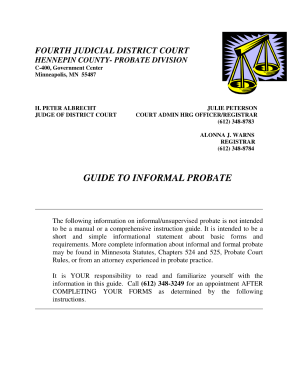

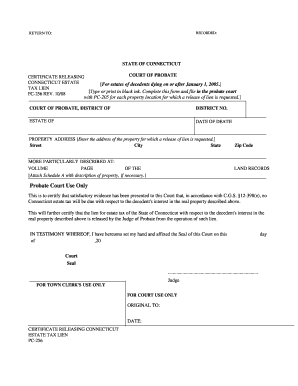

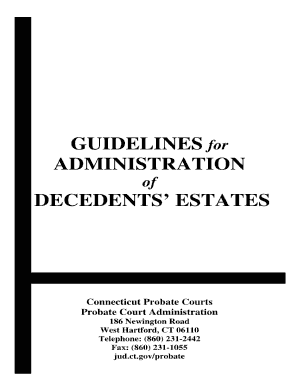

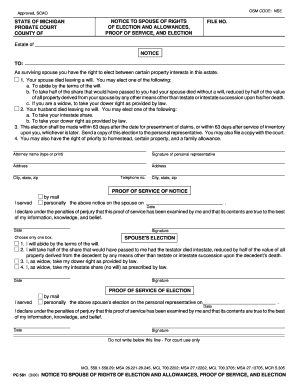

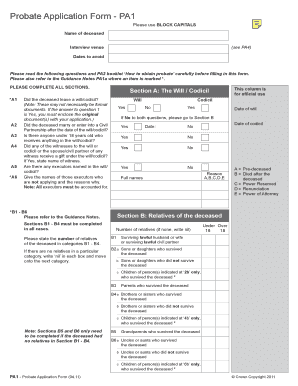

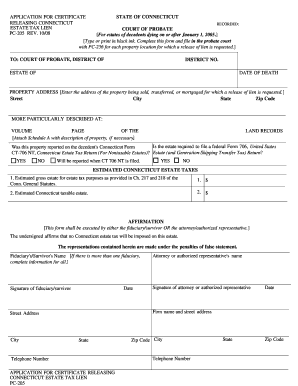

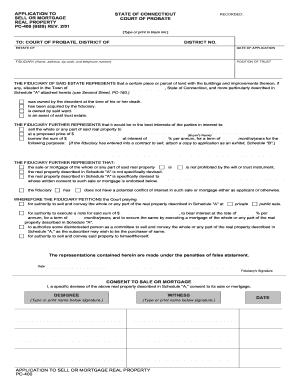

Probate forms are legal documents that are used in the probate process. Probate is the legal procedure for distributing a person's assets and fulfilling their financial obligations after they pass away. These forms are typically required by the court and must be filled out correctly to ensure the proper administration of the estate.

What are the types of Probate Forms?

There are several different types of probate forms, each serving a specific purpose in the probate process. Some common types of probate forms include: 1. Petition for Probate: This form is used to request the court to open the probate case and appoint an executor or personal representative. 2. Inventory and Appraisal Form: This form is used to list and value the deceased person’s assets. 3. Notice of Administration: This form is used to notify creditors and interested parties that the probate process has begun. 4. Final Accounting Form: This form is used to present the final financial report of the estate to the court. 5. Petition for Distribution: This form is used to request the court's approval for the distribution of the estate's assets to the beneficiaries.

How to complete Probate Forms

Completing probate forms can be a complex process, but with the right guidance, it can be done effectively. Here are some steps to help you complete probate forms: 1. Obtain the necessary forms: Start by obtaining the specific probate forms required by your jurisdiction. These forms can usually be found on the court's website or obtained from the probate court clerk. 2. Read the instructions: Carefully read the instructions provided with the forms. These instructions will guide you through the process of completing each form. 3. Gather the required information: Collect all the necessary information and documentation needed to complete the forms. This may include the deceased person's personal information, asset details, and creditor information. 4. Fill out the forms accurately: Take your time to fill out each form accurately and legibly. Double-check all the information before submitting the forms. 5. File the forms with the court: Once the forms are completed, file them with the probate court clerk. Make sure to keep copies for your records. 6. Follow up with the court: After filing the forms, stay in touch with the court to ensure that they have received the forms and to inquire about any further steps or requirements.

pdfFiller provides a convenient and efficient solution for completing probate forms accurately and effortlessly. With its user-friendly interface and comprehensive features, you can easily navigate through the complex probate process and ensure that your forms are completed correctly. Whether you need to create, edit, or share probate forms, pdfFiller simplifies the entire process and saves you valuable time and effort.