Proof Of Income Form

What is proof of income form?

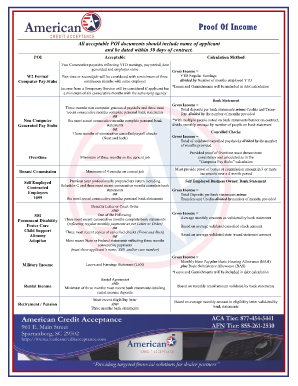

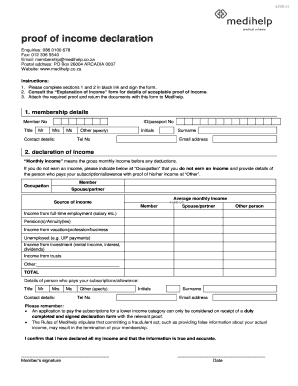

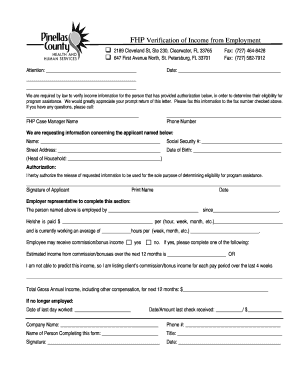

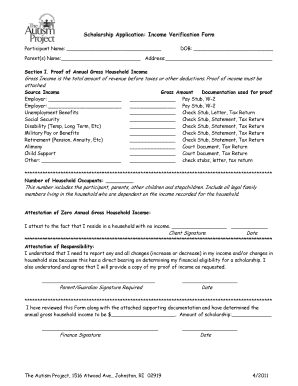

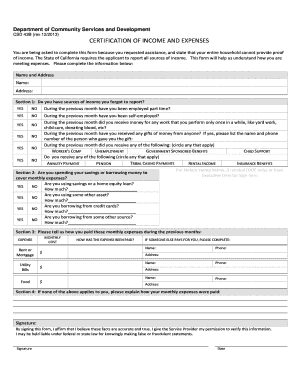

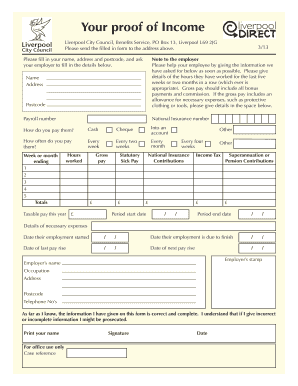

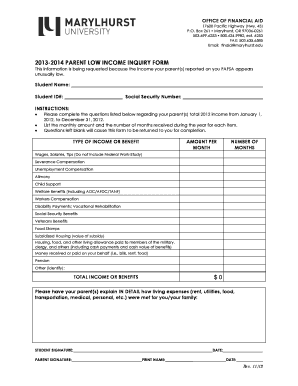

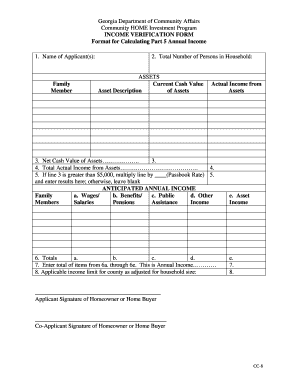

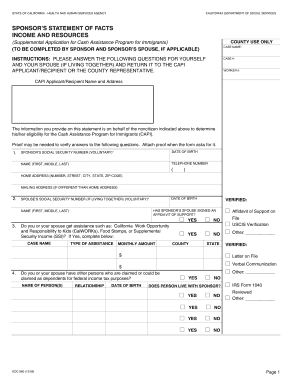

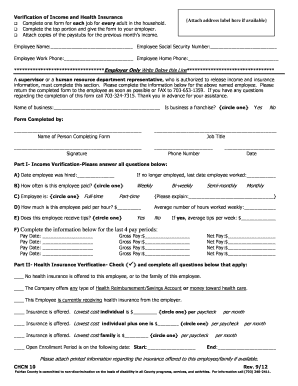

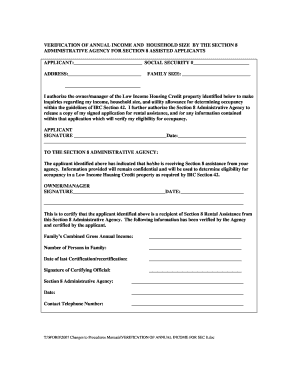

A proof of income form is a document used to verify and provide evidence of an individual's income. It is commonly required when applying for loans, mortgages, or government assistance programs. This form serves as a proof that the individual has a steady source of income and can afford the financial obligations.

What are the types of proof of income form?

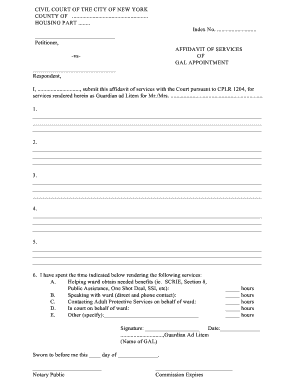

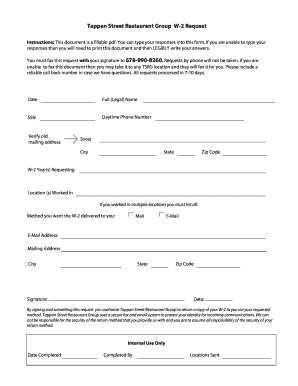

There are several types of proof of income forms that can be used depending on the specific requirements. The most common types include:

How to complete proof of income form

Completing a proof of income form is a relatively straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.