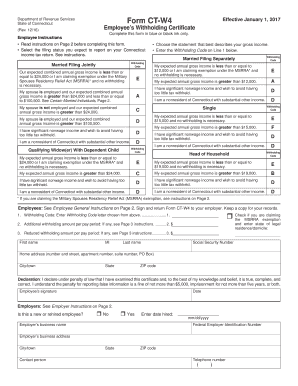

W-4 Form 2017

What is w-4 form 2017?

The W-4 form 2017 is a form used by employees to indicate their tax withholding preferences to their employers. It helps determine how much tax should be withheld from each paycheck based on the employee's filing status and allowances.

What are the types of w-4 form 2017?

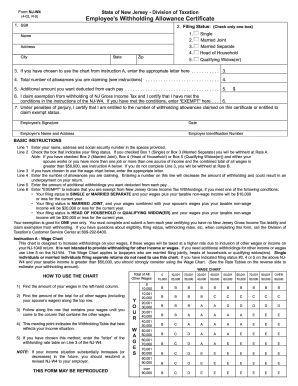

There are two main types of W-4 forms for 2017: the Employee's Withholding Allowance Certificate and the Instructions for Employees. The Employee's Withholding Allowance Certificate is where employees fill out their personal information and withholding preferences. The Instructions for Employees provide detailed guidance on how to fill out the form correctly.

How to complete w-4 form 2017

To complete the W-4 form 2017, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.