Free Business Budget Word Templates

What are Business Budget Templates?

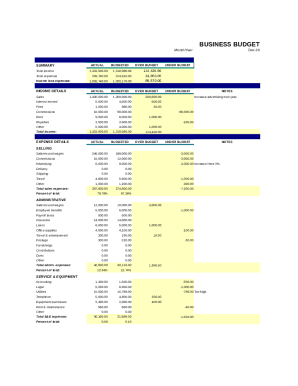

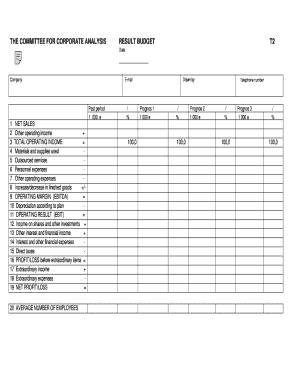

Business Budget Templates are pre-designed spreadsheets or documents that help individuals and businesses plan and track their finances. These templates provide a structured format for organizing income, expenses, and other financial data to create a comprehensive budget.

What are the types of Business Budget Templates?

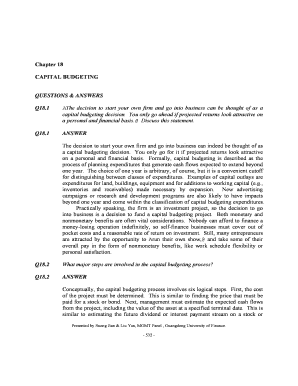

There are several types of Business Budget Templates available, including: 1. Income and Expense Budget Templates 2. Project Budget Templates 3. Marketing Budget Templates 4. Startup Budget Templates 5. Annual Budget Templates

How to complete Business Budget Templates

Completing Business Budget Templates is a simple process that involves the following steps: - Gather all financial data, including income sources and expenses - Input the data into the appropriate sections of the template - Review and analyze the budget to ensure accuracy and feasibility - Make adjustments as needed to achieve financial goals - Save and share the completed budget for future reference

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.