Free Expense Budget Word Templates

What are Expense Budget Templates?

Expense budget templates are pre-designed documents that assist individuals or businesses in managing their finances by outlining planned expenses for a specific period.

What are the types of Expense Budget Templates?

There are several types of expense budget templates, including:

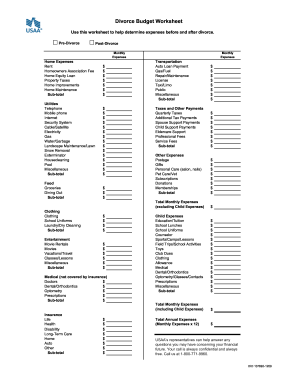

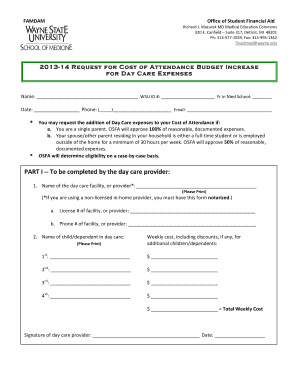

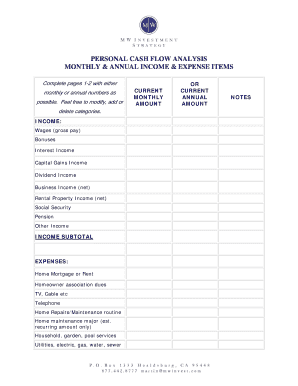

Personal Expense Budget Templates

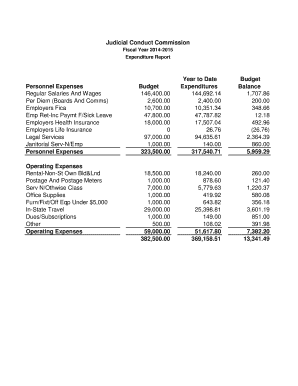

Business Expense Budget Templates

Monthly Expense Budget Templates

Annual Expense Budget Templates

How to complete Expense Budget Templates

Completing expense budget templates is simple and straightforward by following these steps:

01

Gather all financial documents and receipts for reference

02

Enter all income sources and amounts

03

List all planned expenses in respective categories

04

Calculate total income and expenses to ensure balance

05

Review and adjust budget as needed

Remember, with pdfFiller, you can easily create, edit, and share your expense budget templates online, making financial management hassle-free and efficient.

Video Tutorial How to Fill Out Expense Budget Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you prepare an expense budget?

Creating a budget Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

What is the purpose of expense budget?

At the most basic level, a budget is a way to keep track of the money you are getting and the money you are spending. A budget is a great way to make sure that you can cover your expenses from month to month.

What goes on an expense budget?

Expenses mostly include operating expenses, like rent, utilities, advertising, and payroll. That's what I'm talking about in this article. Direct costs are another type of spending—another way to say it is the costs of goods sold (COGS), or what you spend on what you sell.

Which 3 parts of a budget are expenses?

The three main elements, or parts, of a personal budget are income, expenditures, and savings.

What is an expense budget?

Definition: Expenditure Budget shows the revenue and capital disbursements of various ministries/departments and presents the estimates in respect of each under 'Plan' and 'Non-Plan'. Description: It gives a detailed analysis of various types of expenditure and broad reasons for the variations in estimates.

What are the four steps in the expense budget?

Four steps to better budgeting Get organized. Don't just hope for better spending habits to materialize, set SMART (Specific, Measurable, Achievable, Relevant and Time-bound) goals for yourself. Establish a budget. Make a spending journal that tracks all of your expenses. Take control of your debt. Enhance your income.

Related templates