Free Freelancer Budget Word Templates

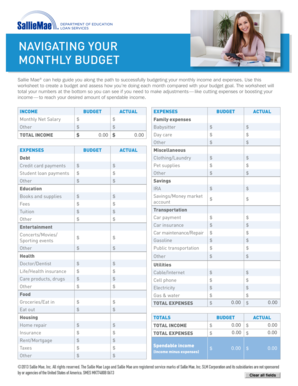

What are Freelancer Budget Templates?

Freelancer Budget Templates are pre-designed documents that help freelancers track their expenses, income, and overall budget. These templates are essential for managing finances and ensuring profitability in freelance work.

What are the types of Freelancer Budget Templates?

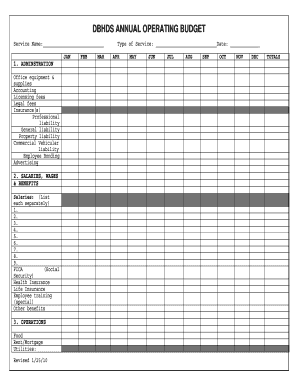

There are several types of Freelancer Budget Templates available to cater to different needs and preferences. Some common types include:

Hourly Rate Budget Template

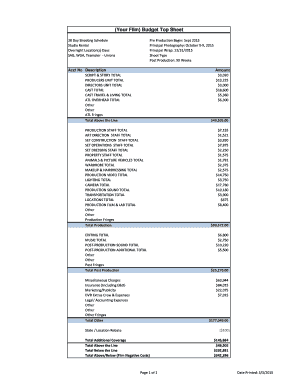

Project-Based Budget Template

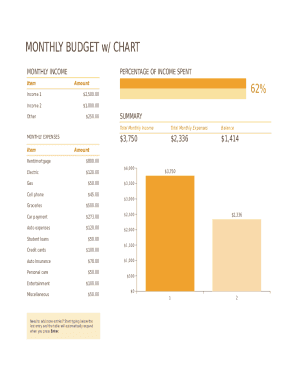

Monthly Expense Budget Template

Yearly Financial Budget Template

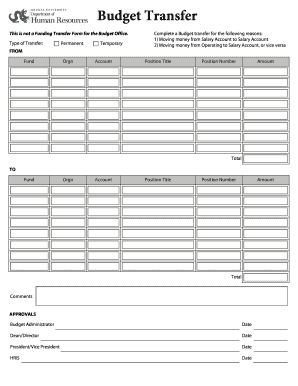

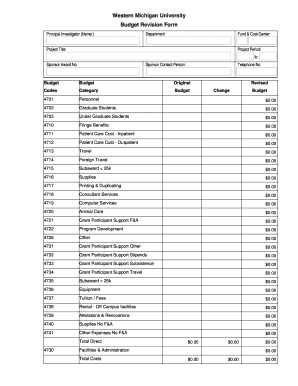

How to complete Freelancer Budget Templates

Completing Freelancer Budget Templates is a simple yet crucial task for freelance professionals. To effectively utilize these templates, follow these steps:

01

Gather all financial records and receipts for accurate data input

02

Organize expenses and income into relevant categories

03

Fill in the template with the corresponding amounts and details

04

Regularly update the budget template to track financial progress

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Freelancer Budget Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a freelance budget?

You can successfully budget as a freelancer by calculating your average monthly income, assessing your monthly expenses, planning for taxes and setting aside savings.In this article: Calculate Your Average Monthly Income. Plan for Taxes. Factor in Your Expenses. Incorporate an Emergency Fund and Savings Into Your Budget.

How much does a freelancer cost?

General figures. ing to the Payoneer survey, which covered 150 countries and over 7,000 freelancers around the world, freelancers on average make $21/hour. Freelancers around the world charge the following hourly rates: up to $5 - 16%

How do freelancers budget for taxes?

You should plan to set aside 25% to 30% of your taxable freelance income to pay both quarterly taxes and any additional tax that you owe when you file your taxes in April. Freelancers must budget for both income tax and FICA taxes. You can use IRS Form 1040-ES to calculate your estimated tax payments.

Is the 50 30 20 rule realistic?

The 50/30/20 rule can be a good budgeting method for some, but whether the system is right for you will be determined by your unique circumstances. Depending on your income and where you live, 50% may not be enough to cover your needs.

Why should freelancers create a budget?

A budget helps freelancers figure out how much money they expect to take in when their invoice templates are paid, how much they spend on business expenses, and how much to save for things like retirement planning. Don't forget to pay yourself a wage to live on!

How do I create a budget that works for me?

Creating a budget Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

Related templates