Free Monthly Budget Word Templates

What are Monthly Budget Templates?

Monthly Budget Templates are pre-designed documents that help individuals and businesses track their expenses, income, and savings for a specific month. These templates are essential tools for financial planning and making informed decisions about where to allocate resources.

What are the types of Monthly Budget Templates?

There are several types of Monthly Budget Templates available, each catering to different needs and preferences. Some common types include:

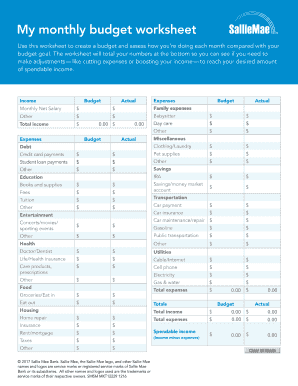

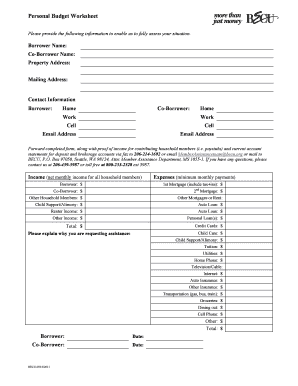

Personal Monthly Budget Template

Business Monthly Budget Template

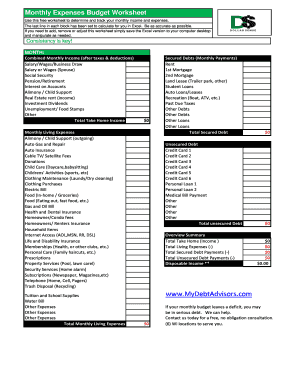

Household Monthly Budget Template

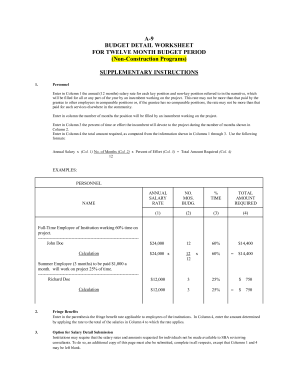

Project Monthly Budget Template

How to complete Monthly Budget Templates

Completing Monthly Budget Templates is a simple process that involves the following steps:

01

Gather all financial information for the month, including income and expenses.

02

Input the data into the designated sections of the template.

03

Review the completed budget to identify areas where adjustments can be made.

04

Make any necessary changes to ensure financial goals are met.

05

Save and keep the budget template for future reference and tracking.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Monthly Budget Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you write a monthly budget?

Creating a budget Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

What is the 50 30 20 budget rule?

One of the most common percentage-based budgets is the 50/30/20 rule. The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings.

How to budget $2,000 a month?

10 Tips to Comfortably Live on $2000 a Month Create a Budget and Stick To It. Extinguish Your Fuel Costs. Save Money on Groceries. Choose an Affordable Cell Phone Plan. Save on Electricity. Choose Affordable Health Care. Spend Less on Rent. Find Free Things to Do Around Town.

What is a typical monthly budget?

September 13, 2022. The average American household spends $5,111 each month. Housing, transportation and healthcare costs are some of the top expenses.

What is a normal monthly budget?

The average American household spends $5,111 each month. Housing, transportation and healthcare costs are some of the top expenses.

What is a good monthly budget?

A good monthly budget should follow the 50/30/20 rule. ing to this method, your monthly take-home income is divided into three categories: 50% for needs, 30% for wants and 20% for savings and debt repayment.

Related templates