Free Sample Budget Word Templates

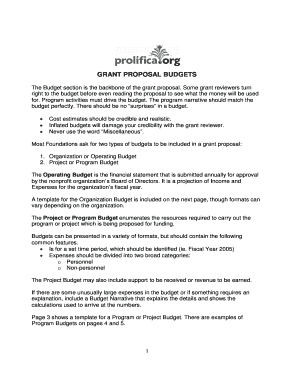

What are Sample Budget Templates?

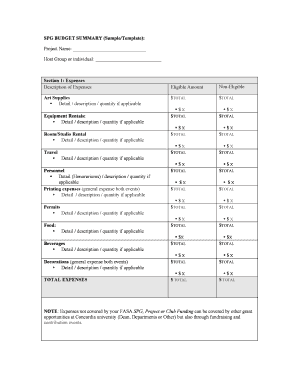

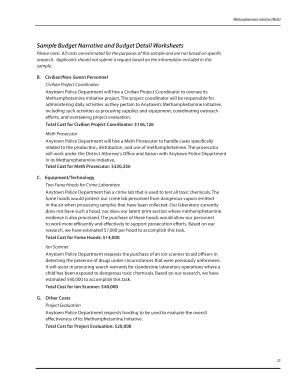

Sample Budget Templates are pre-designed documents that help individuals or businesses organize their finances by outlining income sources, expenses, and savings goals.

What are the types of Sample Budget Templates?

There are various types of Sample Budget Templates available to suit different financial needs:

Monthly Budget Templates

Yearly Budget Templates

Business Budget Templates

Personal Finance Budget Templates

How to complete Sample Budget Templates

Completing Sample Budget Templates is a simple process that can help you gain better control of your finances. Follow these steps:

01

Gather all your financial information, including income sources and expenses.

02

Input your income and expenses into the corresponding sections of the template.

03

Calculate your total income, total expenses, and savings potential.

04

Adjust your budget as needed to meet your financial goals.

05

Save and/or print your completed budget template for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Sample Budget Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

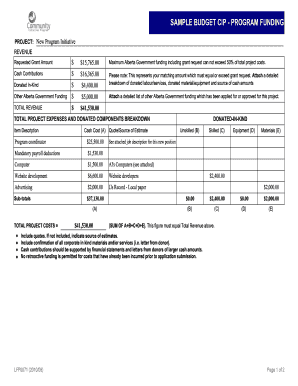

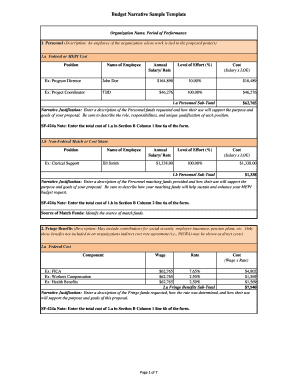

What are the 4 components of a budget?

It includes fixed cost, variable cost, capital costs, and non-operating expenses.

What is a good budget for college students?

Step 4: Create a College Student Budget Many people use the 50/30/20 rule, which calls for putting 50% of your total after-tax income toward needs, 30% toward wants, and 20% toward savings and other financial goals.

What is the example of budget?

Budgeting is the process of forecasting revenues and expenses of the company for a specific period and examples of which include the sales budget prepared to make a projection of the company's sales and the production budget prepared to project the production of the company etc.

What is a sample budget?

A sample budget is a budget from another family that you can look over to help you create your own budget. This isn't something that is discussed often, even amongst friends, so it's really hard to see specifics of how others spend their money.

What is the 50 20 30 budget rule?

By Melissa Green | Citizens Bank Staff One of the most common percentage-based budgets is the 50/30/20 rule. The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings.

What is an example of a good budget?

The 50/30/20 rule is a simple way to budget that doesn't involve a lot of detail and may work for some. That rule suggests you should spend 50% of your after-tax pay on needs, 30% on wants, and 20% on savings and paying off debt.

Related templates