Free Credit Letter Word Templates - Page 4

What are Credit Letter Templates?

Credit Letter Templates are pre-formatted documents designed to help individuals or businesses communicate credit-related information effectively. These templates provide a professional format for conveying credit requests, disputes, inquiries, or other relevant information.

What are the types of Credit Letter Templates?

There are several types of Credit Letter Templates available, including:

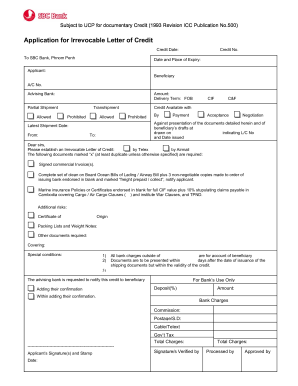

Credit Inquiry Letter Template

Credit Dispute Letter Template

Credit Request Letter Template

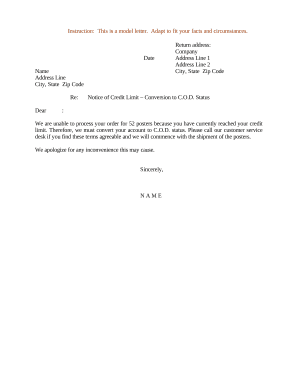

Credit Refusal Letter Template

Credit Verification Letter Template

How to complete Credit Letter Templates

Completing Credit Letter Templates is a straightforward process that involves the following steps:

01

Start by downloading a Credit Letter Template that suits your needs.

02

Fill in the relevant information, such as your name, address, and credit details.

03

Customize the template to include specific details or requests, if necessary.

04

Review the completed letter for accuracy and completeness.

05

Save or print the letter to send it to the intended recipient.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Credit Letter Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

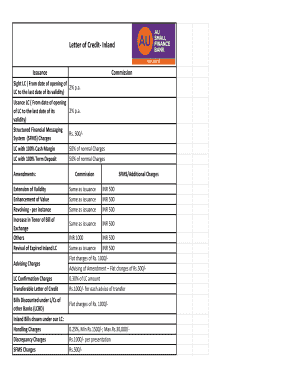

How much does a letter of credit cost?

The process of getting an LC consists of four primary steps, which are enlisted here: Step 1 - Issuance of LC. Step 2 - Shipping of goods. Step 3 - Providing Documents to the confirming bank. Step 4 - Settlement of payment from importer and possession of goods. Letter of Credit (LC) - Meaning, Process & Role In International Trade dripcapital.com https://.dripcapital.com › en-us › resources › blog dripcapital.com https://.dripcapital.com › en-us › resources › blog

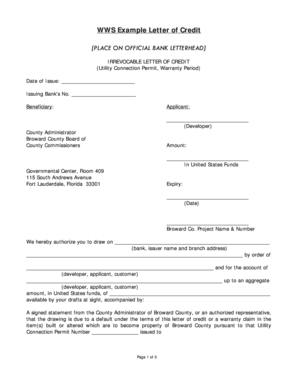

What Is an Example of a Letter of Credit?

Contact the Creditor. Contact the creditor you've selected and ask the requirements for a letter of credit. You'll need to follow the creditor's procedures to get your letter. Provide any documents the creditor requests, such as the agreement you have with the seller and your financial documents.

How Does a Letter of Credit Work?

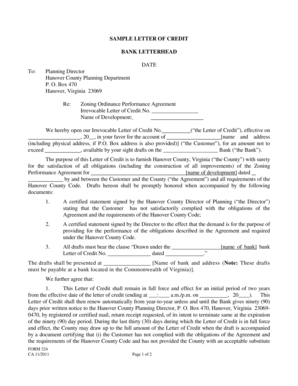

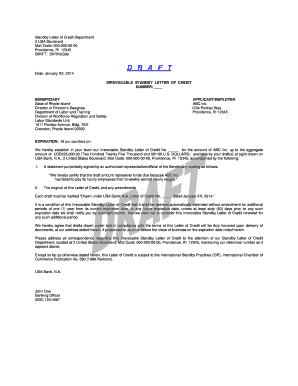

A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

What are 4 types of letter of credit?

It reduces the risk of non-paying buyers In the event that a foreign buyer changes or cancels an order for example, a letter of credit ensures that the seller will still get paid by the buyer's bank for the shipped goods, thus reducing production risk. 5 Advantages of Using a Letter of Credit | DBS BusinessClass India dbs.com https://.dbs.com › sme › articles › business-strategy dbs.com https://.dbs.com › sme › articles › business-strategy

What is credit letter?

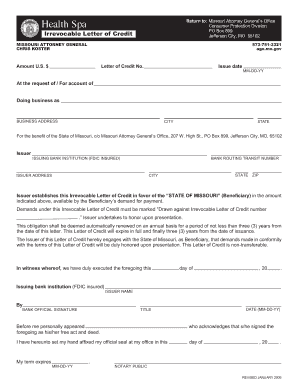

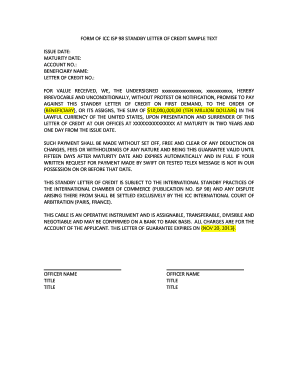

Main types of LC Irrevocable LC. This LC cannot be cancelled or modified without consent of the beneficiary (Seller). Revocable LC. Stand-by LC. Confirmed LC. Unconfirmed LC. Transferable LC. Back-to-Back LC. Payment at Sight LC.

How do you apply for a letter of credit?

A guiding principle of an LC is that the issuing bank will make the payment based solely on the documents presented, and they are not required to physically ensure the shipping of the goods. If the documents presented are in with the terms and conditions of the LC, the bank has no reason to deny the payment. Letter of Credit (LC) - Meaning, Process & Role In International Trade dripcapital.com https://.dripcapital.com › resources › blog › letter-o dripcapital.com https://.dripcapital.com › resources › blog › letter-o