Free Guarantee Letter Word Templates

What are Guarantee Letter Templates?

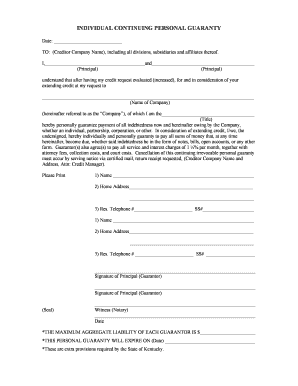

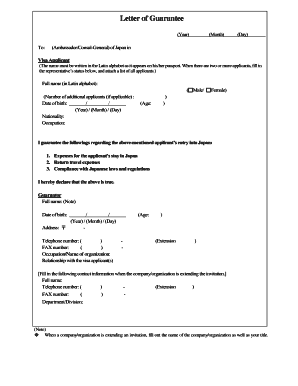

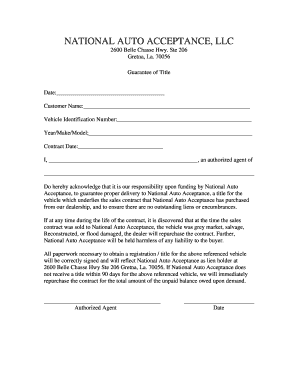

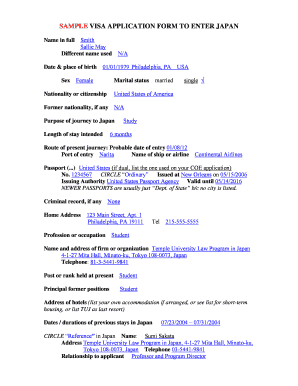

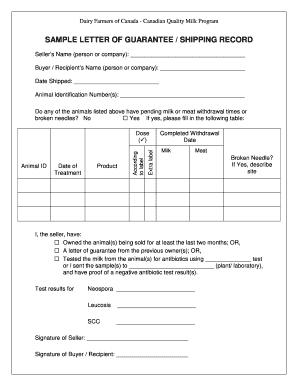

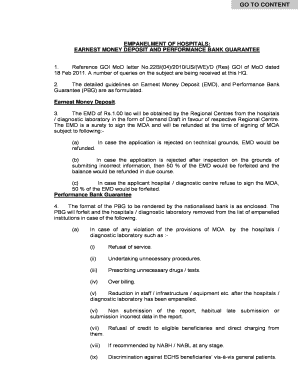

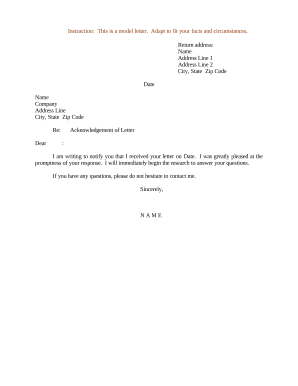

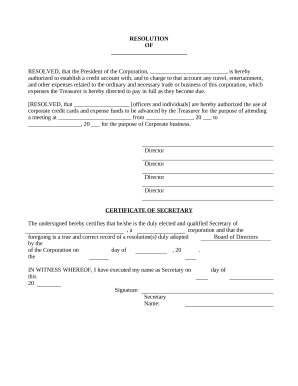

A Guarantee Letter Template is a pre-formatted document that outlines the terms and conditions of a guarantee agreement. It serves as a legal document that provides assurance to a party that their financial interests will be protected in case the agreed-upon terms are not met.

What are the types of Guarantee Letter Templates?

There are several types of Guarantee Letter Templates available, including:

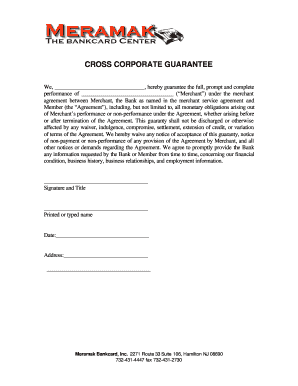

Financial Guarantee Letter Template

Payment Guarantee Letter Template

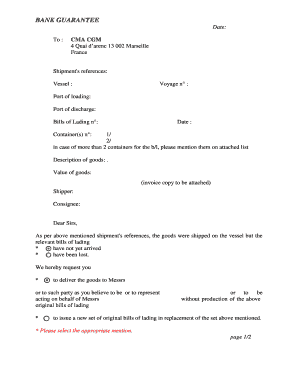

Performance Guarantee Letter Template

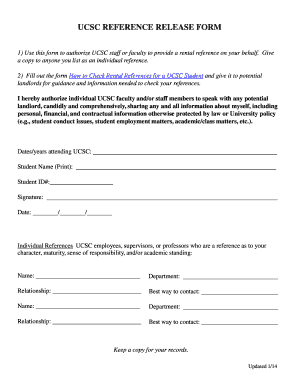

Rental Guarantee Letter Template

How to complete Guarantee Letter Templates

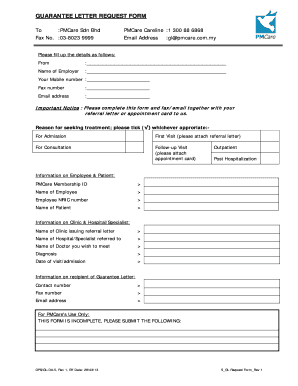

Completing a Guarantee Letter Template is a straightforward process that involves the following steps:

01

Download the desired Guarantee Letter Template from a reputable source.

02

Fill in the relevant details, including names, dates, and terms of the guarantee agreement.

03

Review the completed document for accuracy and completeness.

04

Save and/or print the document for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Guarantee Letter Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

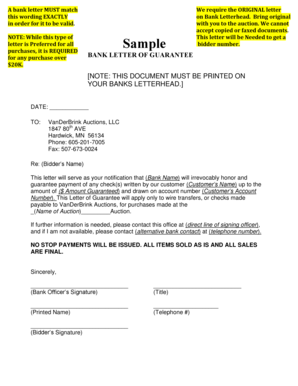

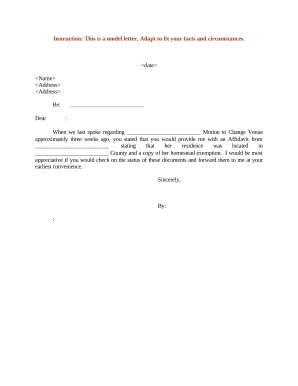

What is an example of a guarantee letter?

Dear Sir/Madam: This letter will serve as your notification that (Bank Name) will irrevocably honor and guarantee payment of any check(s) written by our customer (Customer's Name) up to the amount of (Amount Guaranteed) and drawn on account number (Customer's Account Number). No stop payments will be issued.

How do I write a guarantee letter?

How do I write a letter of guarantee? Reviewing your agreement. You need to feel comfortable with the terms before you agree to compose the letter. Formatting your letter. It's recommended that you type the letter instead of writing it down. Writing the content of your letter. Finishing your letter and submitting it.

How do you write a guarantee statement?

Writing a Guarantee A statement letting your potential customers know you believe in your product. Give the customer a fair time period to try the product. State what happens if the customer isn't happy with the product. Finally, the most important elements of your guarantee are honesty and transparency.

What should a guarantor letter say?

In the letter, the guarantor must provide the following information: the name of the guarantor or parent, the monthly amount of payment guaranteed, the name of the renter, the complete address of the property, the amount of deposit, the driver's license number, the date of birth, the guarantor's home address, the

What is the purpose of guarantee?

The guarantee is a contract by which a natural or legal person guarantees or assures the fulfillment of obligations, assuming the payment a debt of another person if this does not.

How do you write a simple guarantor letter?

Write out your qualifications as a guarantor -- your income, assets and other personal details supporting why you would be able to take responsibility should the tenant or borrower fail to do so. You can also list your accountant to testify to your financial state, as well as other character references.