Free Hardship Letter Word Templates

What are Hardship Letter Templates?

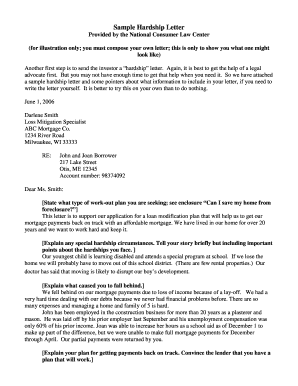

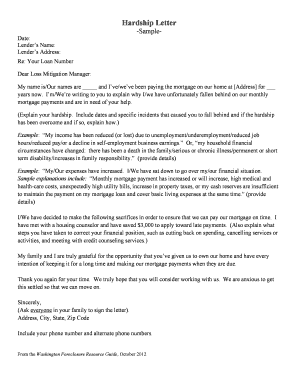

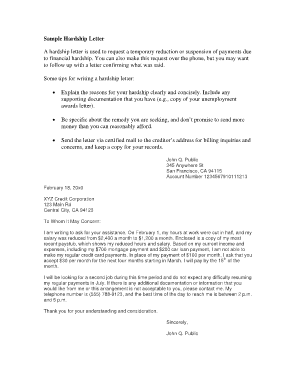

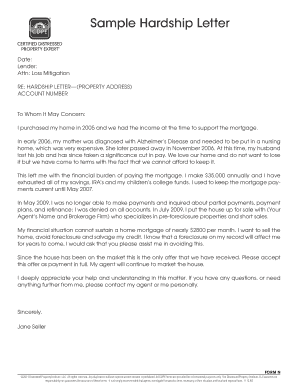

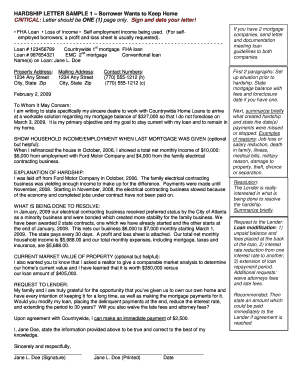

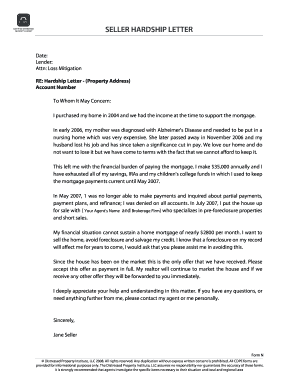

Hardship Letter Templates are pre-written documents that individuals can use when they are facing a difficult situation and need to request assistance or special considerations. These templates provide a structured format for conveying personal hardship and requesting help from a financial institution, employer, or other organizations.

What are the types of Hardship Letter Templates?

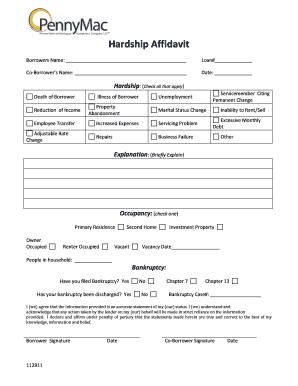

There are several types of Hardship Letter Templates available to address different situations. Some common types include:

How to complete Hardship Letter Templates

Completing a Hardship Letter Template can seem daunting, but with a clear step-by-step approach, it can be easily done. Here are some tips to help you complete a Hardship Letter Template:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.