Free Loan Letter Word Templates

What are Loan Letter Templates?

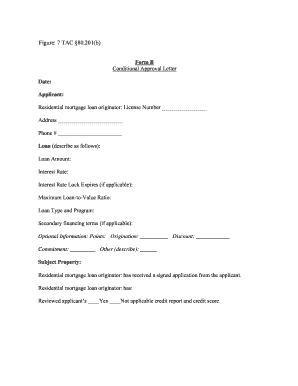

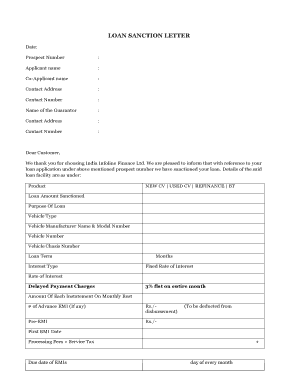

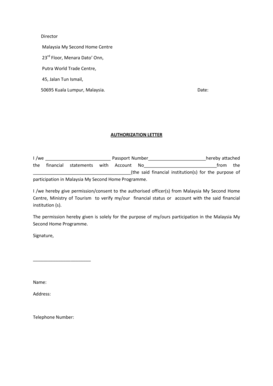

Loan Letter Templates are pre-designed documents that individuals or businesses can use to clearly outline the terms and conditions of a loan agreement. These templates serve as a structured format for borrowers and lenders to communicate critical information about the loan, such as repayment schedules, interest rates, and any collateral involved.

What are the types of Loan Letter Templates?

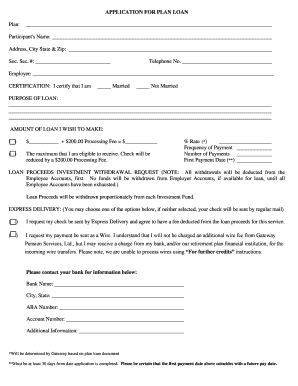

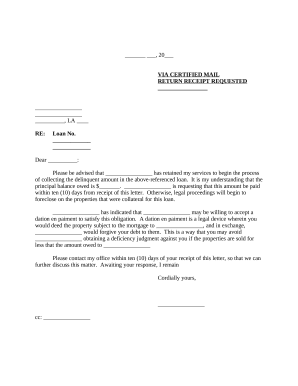

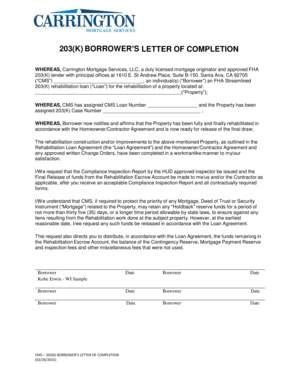

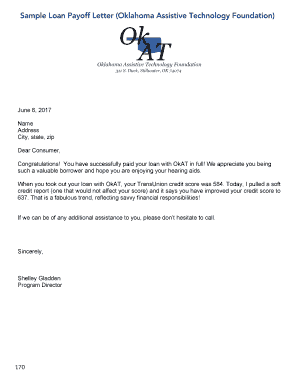

There are several types of Loan Letter Templates available, each catering to different loan situations. Some common types include: 1. Personal Loan Agreement Template 2. Business Loan Agreement Template 3. Promissory Note Template 4. Loan Repayment Agreement Template 5. Loan Application Template 6. Loan Modification Agreement Template

How to complete Loan Letter Templates

Completing Loan Letter Templates is a straightforward process that involves filling in the necessary information accurately. Here are the steps to complete a Loan Letter Template:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.