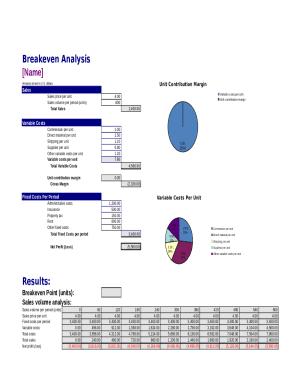

What is Breakeven Analysis Template?

A Breakeven Analysis Template is a tool used to determine the point at which revenue equals expenses, providing businesses with valuable insights into their financial performance. It helps businesses understand the minimum amount of sales needed to cover costs and start generating profits.

What are the types of Breakeven Analysis Template?

There are several types of Breakeven Analysis Templates available, each suited for different business models and industries. Some common types include:

How to complete Breakeven Analysis Template

Completing a Breakeven Analysis Template is a straightforward process that can provide valuable insights into your business's financial health. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.