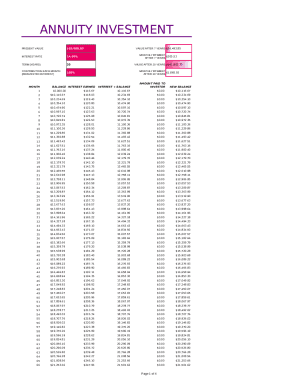

What is Annuity Investment Calculator?

An Annuity Investment Calculator is a tool that helps you calculate the growth of your annuity investment over time. It takes into account factors like the initial investment amount, annual interest rate, and the length of the investment period to give you an estimate of how much you can expect to earn.

What are the types of Annuity Investment Calculator?

There are two main types of Annuity Investment Calculators: Fixed Annuity Calculator and Variable Annuity Calculator.

How to complete Annuity Investment Calculator

Completing an Annuity Investment Calculator is a simple process that involves entering the required information and letting the calculator do the rest. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.