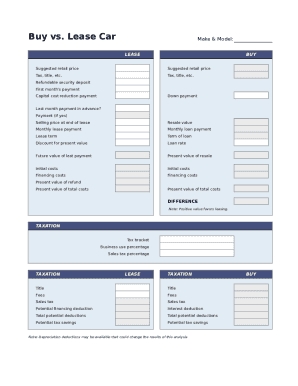

What is Buy Vs Lease Car Calculator?

Buy Vs Lease Car Calculator is a tool that helps users compare the costs of buying a car versus leasing it. It takes into account factors such as the vehicle's price, loan interest rates, lease terms, and expected mileage.

What are the types of Buy Vs Lease Car Calculator?

There are primarily two types of Buy Vs Lease Car Calculators: basic calculators that consider the upfront costs, monthly payments, and total cost over a certain period, and advanced calculators that also factor in variables like resale value, maintenance expenses, and tax implications.

How to complete Buy Vs Lease Car Calculator

Completing a Buy Vs Lease Car Calculator is simple and straightforward. Follow these steps to make an informed decision:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.