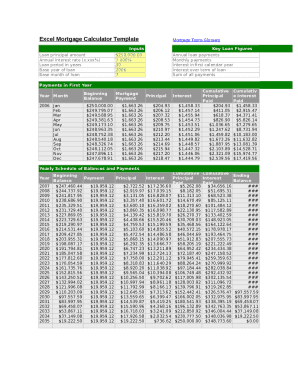

What is Loan Payment Calculator Excel?

A Loan Payment Calculator Excel is a financial tool used to calculate the monthly payments on a loan based on various factors such as the loan amount, interest rate, and term length. It helps users estimate how much they need to pay each month towards their loan.

What are the types of Loan Payment Calculator Excel?

There are different types of Loan Payment Calculator Excel available, tailored to specific loan types or payment structures. Some common types include:

How to complete Loan Payment Calculator Excel

Completing a Loan Payment Calculator Excel is a straightforward process that involves entering the necessary information and letting the tool do the calculations for you. Here are the steps to complete a Loan Payment Calculator Excel:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.