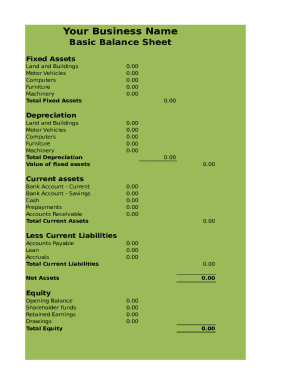

What is Depreciation Schedule Template?

A Depreciation Schedule Template is a tool used by businesses to record and track the depreciation of their assets over time. This template organizes and calculates the decrease in value of assets due to wear and tear, ensuring accurate financial reporting.

What are the types of Depreciation Schedule Template?

There are several types of Depreciation Schedule Templates available, each suited for different asset types and depreciation methods. The common types include:

Straight-Line Depreciation Template

Double-Declining Balance Depreciation Template

Units of Production Depreciation Template

How to complete Depreciation Schedule Template

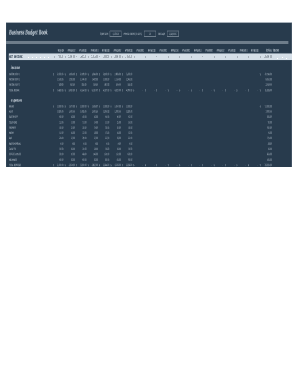

Completing a Depreciation Schedule Template is a straightforward process that involves the following steps:

01

Gather information on the asset's original cost, useful life, and salvage value.

02

Select the appropriate depreciation method based on the asset type and business needs.

03

Calculate the depreciation expense for each period using the chosen method.

04

Record the depreciation expense in the template and update the asset's book value.

05

Review and adjust the schedule periodically to ensure accuracy and compliance with accounting standards.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Depreciation Schedule Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is equipment depreciated over 5 or 7 years?

The most common non-real estate assets and the designated number of years over which they can be depreciated are as follows: Three years: Tractors, certain manufacturing tools, some livestock. Five years: Computers, office equipment, cars, light trucks, construction assets. Seven years: Office furniture and appliances.

What is the most common depreciation schedule?

Straight-Line Method: This is the most commonly used method for calculating depreciation. In order to calculate the value, the difference between the asset's cost and the expected salvage value is divided by the total number of years a company expects to use it.

What depreciation schedule should I use?

Most businesses use the straight line method for depreciating assets. Most of the time there's no good reason for a small business to choose any other method. Under the straight line method, your business asset is depreciated by a uniform amount for every year of its useful life.

How do you create a depreciation schedule?

Divide the expected units to be produced for each year by the total expected units over the asset's life, then multiply the result by the difference of price and salvage value to find the depreciation for each year.

What is the standard property depreciation schedule?

Depreciation commences as soon as the property is placed in service or available to use as a rental. By convention, most U.S. residential rental property is depreciated at a rate of 3.636% each year for 27.5 years. Only the value of buildings can be depreciated. you cannot depreciate land.

What is the standard depreciation schedule?

A depreciation schedule charts the loss in value of an asset over the period you've designated as its useful life, using the accounting method you've chosen. The point of having a depreciation schedule is to give you the ability to track what you've already deducted and stay on top of the process.

Related templates