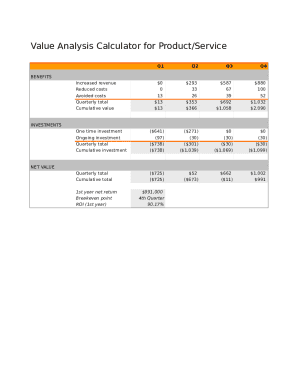

Present Value Analysis Calculator

What is Present Value Analysis Calculator?

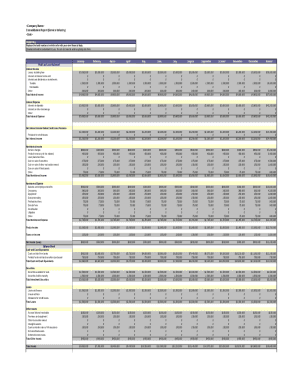

The Present Value Analysis Calculator is a financial tool used to calculate the current value of a sum of money that will be received or paid in the future, taking into account factors such as interest rates and time frames. It helps users make informed decisions about investments or loans by determining the worth of future cash flows in today's terms.

What are the types of Present Value Analysis Calculator?

There are two main types of Present Value Analysis Calculators: Simple Present Value Calculator and Discounted Cash Flow (DCF) Calculator. Both types serve the same purpose but utilize different formulas and inputs to arrive at the present value of future cash flows.

How to complete Present Value Analysis Calculator

Completing the Present Value Analysis Calculator is a straightforward process that involves entering relevant information such as future cash flow amounts, interest rates, and time periods. Here are the steps to complete the calculation:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. Start using pdfFiller today for all your document needs!