What is Car Lease Vs Buy Calculator?

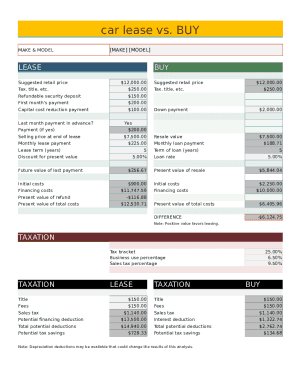

The Car Lease Vs Buy Calculator is a handy tool that helps you compare the costs of leasing versus buying a car. It takes into account factors like monthly payments, down payment, interest rates, depreciation, and more to give you a comprehensive view of which option may be better for you.

What are the types of Car Lease Vs Buy Calculator?

There are mainly two types of Car Lease Vs Buy Calculators available: online calculators and downloadable spreadsheets. Online calculators provide quick and easy calculations based on user inputs, while downloadable spreadsheets offer more customization and allow for offline use.

How to complete Car Lease Vs Buy Calculator

To complete the Car Lease Vs Buy Calculator, follow these simple steps:

Don't forget, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.