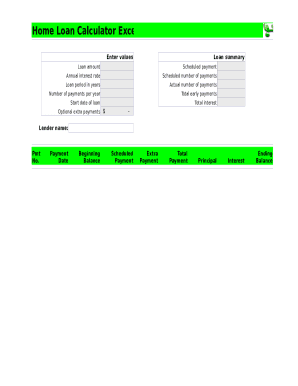

What is Home Loan Calculator Excel?

A Home Loan Calculator Excel is a tool that helps you calculate your potential mortgage payments based on the loan amount, interest rate, and loan term. It provides a quick and easy way to estimate how much you can afford to borrow and what your monthly payments will be.

What are the types of Home Loan Calculator Excel?

There are several types of Home Loan Calculator Excel available, including: 1. Basic Calculator - for simple calculations of monthly payments. 2. Advanced Calculator - for more detailed analysis, including amortization schedules. 3. Refinance Calculator - to help you determine if refinancing your mortgage is a good financial decision.

How to complete Home Loan Calculator Excel

To complete a Home Loan Calculator Excel, follow these steps: 1. Enter your loan amount - the total amount of money you plan to borrow. 2. Input the interest rate - the annual percentage rate charged by the lender. 3. Specify the loan term - the number of years you have to repay the loan. 4. Press the calculate button to see your estimated monthly payment.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.