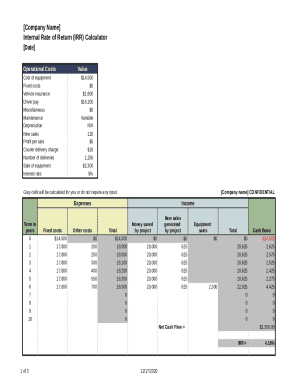

Internal Rate Of Return Calculator

What is Internal Rate Of Return Calculator?

An Internal Rate of Return (IRR) Calculator is a tool used to calculate the potential profitability of an investment. It helps determine the annualized rate of return generated by an investment over a period of time.

What are the types of Internal Rate Of Return Calculator?

There are primarily two types of Internal Rate of Return calculators: Simple IRR Calculator and Advanced IRR Calculator.

Simple IRR Calculator

Advanced IRR Calculator

How to complete Internal Rate Of Return Calculator

Completing an Internal Rate of Return Calculator is easy and straightforward. Here are the steps to follow:

01

Enter the initial investment amount

02

Add the cash inflows and outflows for each period

03

Calculate the IRR using the formula or an online IRR calculator

04

Interpret the results to determine the profitability of the investment

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Internal Rate Of Return Calculator

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is 20% IRR over 5 years?

In other words, if you are provided an IRR of 20% and asked to determine the proceeds achieved in year 5, the result is simple: Your investment will grow by 20% for 5 years. This works out to 2.49.

How do I calculate internal rate of return?

How to Calculate IRR (Step-by-Step) Step 1 → The future value (FV) is divided by the present value (PV) Step 2 → The amount is raised to the inverse power of the number of periods (i.e., 1 ÷ n) Step 3 → From the resulting figure, one is subtracted.

How do I manually calculate IRR in Excel?

Trial and error method for IRR calculations in Excel Start with a guess of the discount rate 'r' Calculate NPV using the 'r' – refer to our tutorials on how to calculate an NPV with or without Excel formulae. If the NPV is close to zero, then 'r' is the IRR. If the NPV is positive, increase 'r'

How do you calculate IRR quickly?

So the rule of thumb is that, for “double your money” scenarios, you take 100%, divide by the # of years, and then estimate the IRR as about 75-80% of that value. For example, if you double your money in 3 years, 100% / 3 = 33%. 75% of 33% is about 25%, which is the approximate IRR in this case.

What is internal rate of return example?

As such, IRR gives the yield rate, or the expected return on investment, shown as a percentage of the investment. For example, a $10,000 investment with a 20% IRR would generate $2,000 in profit.

What is 15% IRR over 5 years?

The 15% IRR over 5 years would produce $1.15 for each invested dollar, but as the interest compounds over a longer timespan, that $1.15 grows to a 2.0 equity multiple for a $2 return on each invested dollar. The investment with a lower IRR had a higher equity multiple, which means it created more wealth.

Related templates