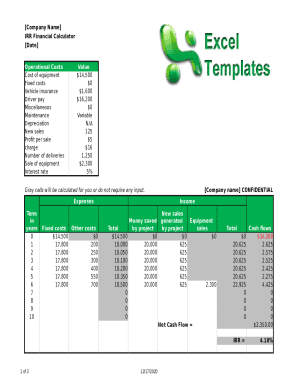

What is Irr Financial Calculator?

Irr Financial Calculator is a powerful tool that helps users calculate Internal Rate of Return (IRR) for investment projects. It is a valuable tool used by investors and financial analysts to assess the profitability of potential investments.

What are the types of Irr Financial Calculator?

There are several types of Irr Financial Calculator available, each with its own unique features and benefits. Some popular types include online calculators, software-based calculators, and handheld calculators.

How to complete Irr Financial Calculator

Completing an Irr Financial Calculator is a straightforward process that involves entering the initial investment, cash flows, and discount rate. Follow these steps to accurately calculate the IRR:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.