Business Loan Application Letter Sample Doc

What is Business loan application letter sample doc?

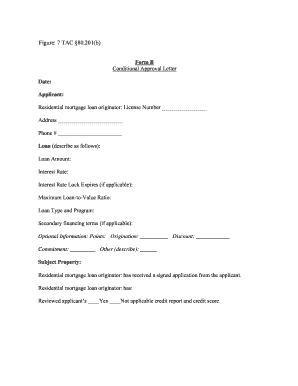

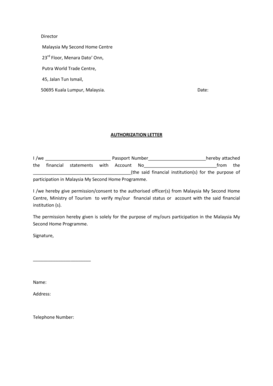

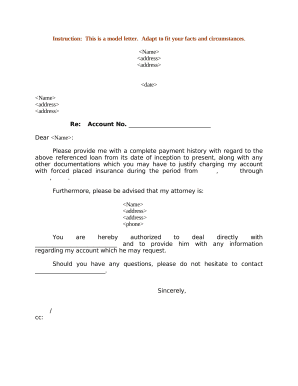

A Business loan application letter sample doc is a document that individuals or businesses use to apply for a loan from a financial institution. It is a formal letter that outlines the borrower's request for a loan, along with their financial information, business plan (if applicable), and any other relevant details.

What are the types of Business loan application letter sample doc?

There are several types of Business loan application letter sample doc, including:

Standard Business loan application letter sample doc

Small Business loan application letter sample doc

Startup Business loan application letter sample doc

Personal Business loan application letter sample doc

How to complete Business loan application letter sample doc

Completing a Business loan application letter sample doc is simple and straightforward. Here are the steps to follow:

01

Start by addressing the letter to the appropriate loan officer or financial institution

02

Clearly state the purpose of the loan and the amount requested

03

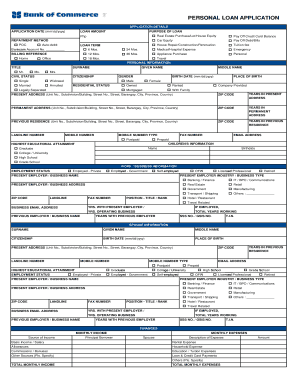

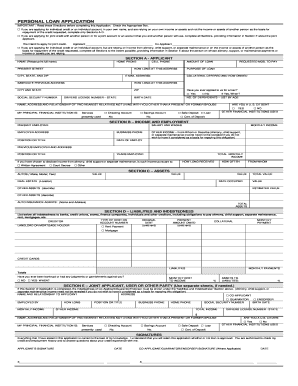

Provide detailed information about your business, including financial statements, credit history, and any collateral you may have

04

Include any supporting documents such as business plans, income projections, and personal financial statements

05

End the letter with a polite closing and your contact information

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Business loan application letter sample doc

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What do I bring to the bank for a business loan?

Although loan requirements will vary from lender to lender, here are some important documents to prepare when applying for a small business loan. Credit report. Bank statements. Income statement. Budget. Business plan. Income tax returns.

Is it difficult to get a small business loan?

Securing a small business loan isn't easy for every business. Many factors are used to evaluate a business, but those with a high annual revenue and healthy credit score may have an easier time getting approved compared to a new business with a low annual revenue or poor credit score.

What do you say on an SBA loan application?

All SBA loan applications will ask you to submit a business plan detailing the future projections for your business. This should include both financial projections like future sales, cash flow, and profit margin, and your company's more qualitative goals like its mission, values, and brand promise.

What is usually required for a business loan?

What do banks require for a small-business loan? Banks generally require that you have good to excellent credit (score of 690 or higher), strong finances and at least two years in business to qualify for a loan. They'll likely require collateral and a personal guarantee as well.

How to write a loan application letter for business?

However, they should be written professionally and in great detail. Heading And Greeting. Summary of Your Business Loan Request Letter. Basic Information About Your Business. Description Of The Purpose Of The Loan. Show Your Ability to Repay the Loan. Concluding Elements.

How do I write a letter to borrow a loan?

It depends on the borrower to decide what information to include, but the following items are typically included in an application letter: Contact information. Explanation of why money is needed. Amount of money being requested. Purpose of the money. Details about employment history. Personal references. Company information.