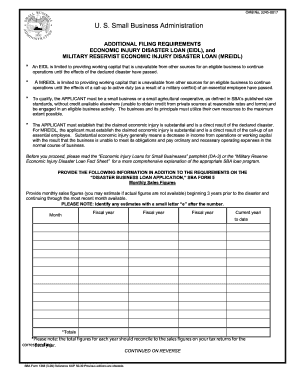

Letter From Sba Eidl

What is Letter from sba eidl?

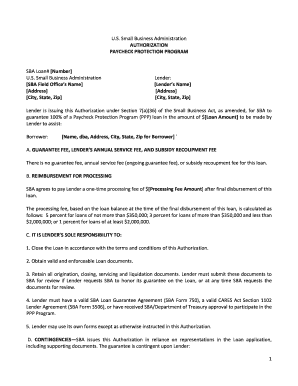

A Letter from SBA EIDL is a communication from the Small Business Administration regarding the Economic Injury Disaster Loan program. It typically contains important information about the loan application, approval, disbursement, and repayment terms.

What are the types of Letter from sba eidl?

There are several types of Letters from SBA EIDL that applicants may receive, including: Approval Letters, Disbursement Notifications, Repayment Terms Updates, and Loan Status Updates.

Approval Letters

Disbursement Notifications

Repayment Terms Updates

Loan Status Updates

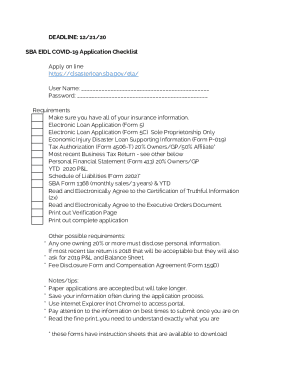

How to complete Letter from sba eidl

To complete a Letter from SBA EIDL, follow these simple steps:

01

Read the letter carefully and understand its contents

02

Follow any instructions provided in the letter

03

Take note of any deadlines or actions required

04

Contact the SBA if you have any questions or need clarification

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Letter from sba eidl

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What happens if you can't pay back the SBA EIDL loan?

Aside from ruining your credit and making it more difficult or costly to get loans in the future, additional consequences include: The SBA can seize and sell any business assets, for example, equipment, furniture, computers, and vehicles, then apply the proceeds to the debt.

Why did I get a letter from the SBA?

This letter is in response to your inquiry to the U.S. Small Business Administration (SBA) that your identity was used, without your knowledge or permission, to obtain a COVID-19 Economic Injury Disaster Loan (EIDL) for which you never received any of the loan proceeds.

Does the SBA have to be paid back?

Small businesses receive loans from SBA partner lenders and the borrower is obligated to pay this lender back.

Do I have to pay back Covid Eidl?

You are responsible for your COVID-19 EIDL monthly payment obligation beginning 30 months from the disbursement date shown on the top of the front page of your Original Note. During this deferment: You may make voluntary payments without prepayment penalties.

Will EIDL loans eventually be forgiven?

There are two parts to the EIDL program: loans and grants. The EIDL loan — which can be as high as $2 million — is generally not forgivable. You'll need to repay an EIDL loan, but grants do not need to be forgiven or repaid. Here's a quick breakdown of which stimulus programs are forgivable.

What happens if you don't pay SBA back?

The SBA Will Initiate Collections The SBA guarantees all partner lenders 50% to 80% of the loan, even if you don't pay. In case of default, the SBA will pay up to 85% of the loan amount. Though the amount they actually pay your lender will be 85% of the loan minus the debt recovered from selling your assets.