Small Business Loan Application Example

What is Small business loan application example?

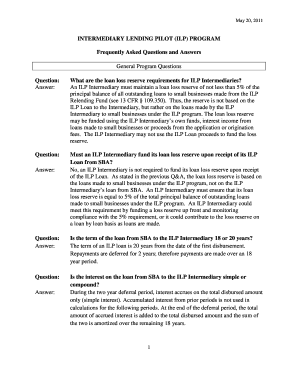

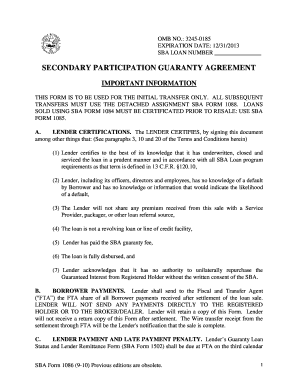

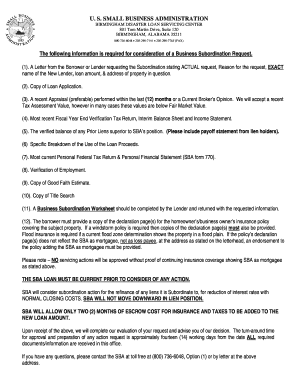

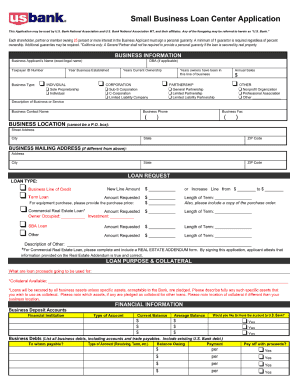

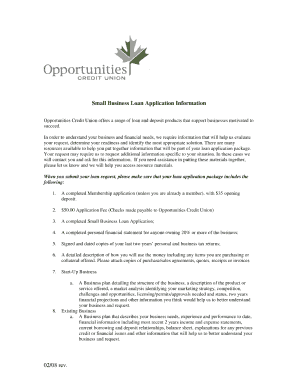

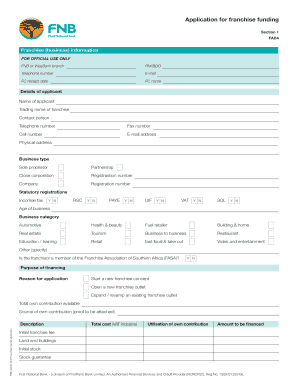

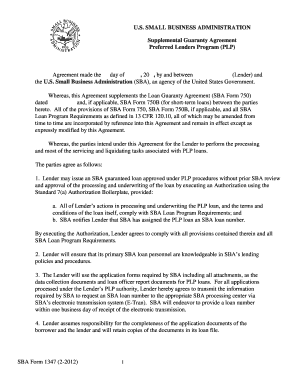

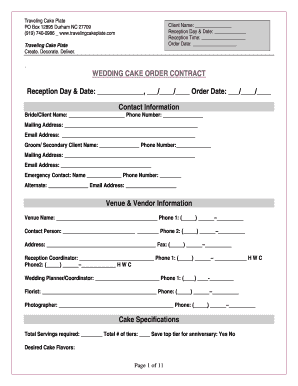

Applying for a small business loan can be a crucial step in growing your business or managing expenses. A small business loan application example is a document that outlines the necessary information and financial details required by a lending institution to consider your loan request. It typically includes details about your business, such as revenue, financial statements, and business plan.

What are the types of Small business loan application example?

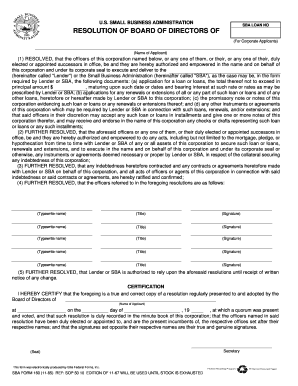

There are several types of small business loan applications, including: 1. Traditional Term Loans 2. SBA Loans 3. Business Lines of Credit 4. Equipment Financing 5. Invoice Financing Each type of loan has its own set of requirements and benefits, so it's essential to research and choose the best option for your business needs.

How to complete Small business loan application example

Completing a small business loan application example can seem daunting, but with the right preparation, it can be a smooth process. Here are some steps to help you complete your application successfully:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.