Wells Fargo Personal Financial Statement - Page 2

What is Wells Fargo Personal Financial Statement?

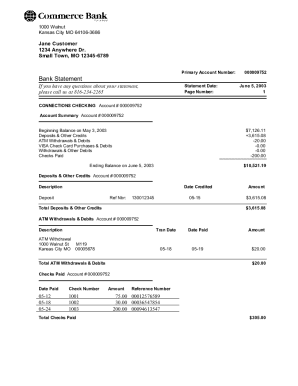

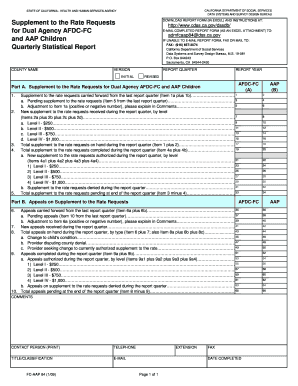

The Wells Fargo Personal Financial Statement is a document that provides an overview of an individual's financial situation. It includes details such as income, expenses, assets, and liabilities. This statement is often required by banks and financial institutions when applying for loans or credit.

What are the types of Wells Fargo Personal Financial Statement?

There are two main types of Wells Fargo Personal Financial Statements: The Personal Financial Statement for SBA Loan Program, and the Personal Financial Statement for Expat Clients. Each type caters to specific financial needs and requirements.

How to complete Wells Fargo Personal Financial Statement

Completing the Wells Fargo Personal Financial Statement is a straightforward process. Here are some steps to help you fill out the form accurately:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.