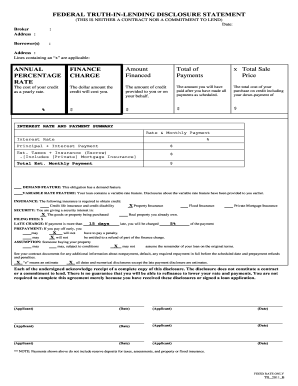

Truth In Lending Disclosure Sample - Page 2

What is Truth in lending disclosure sample?

The Truth in Lending Act (TILA) requires lenders to provide borrowers with a Truth in Lending Disclosure, which is a document that outlines the terms and costs of the loan they are applying for. The disclosure includes important information such as the annual percentage rate (APR), finance charges, total amount financed, and the total payments required.

What are the types of Truth in lending disclosure sample?

There are different types of Truth in Lending Disclosure samples that are tailored to specific loan products and transactions. Some common types include:

How to complete Truth in lending disclosure sample

Completing a Truth in Lending Disclosure sample is a straightforward process that can help borrowers fully understand the terms of their loan. Here are the steps to complete the disclosure:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.