W9 Request

What is W9 request?

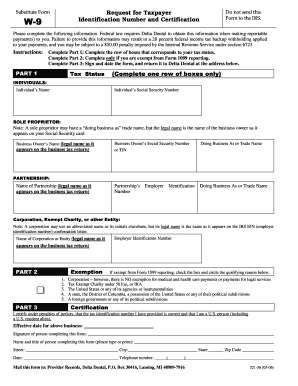

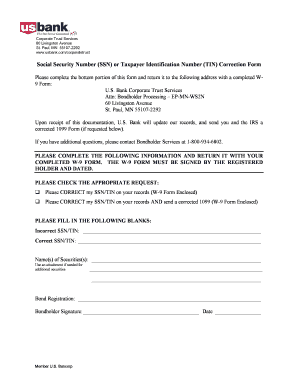

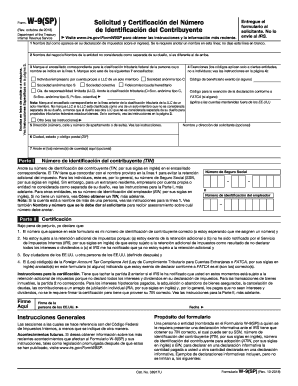

A W9 request is a form that businesses use to collect information from individuals or vendors who provide services to them as independent contractors. The form is used to gather the recipient's taxpayer identification number (TIN) and other relevant info for tax reporting purposes.

What are the types of W9 request?

There are two main types of W9 requests that businesses commonly use:

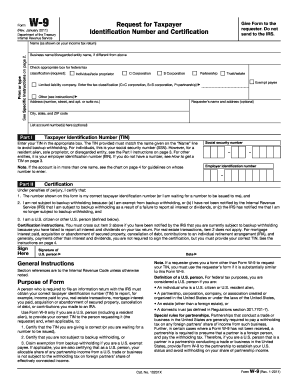

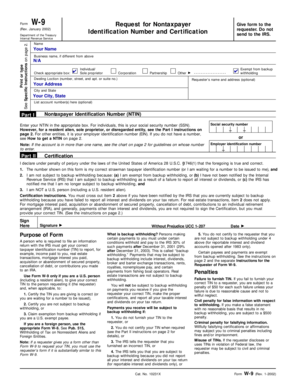

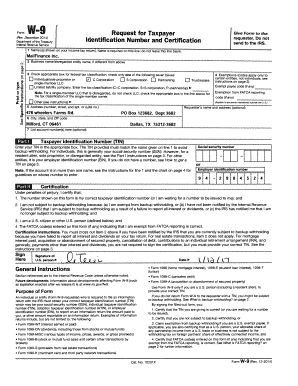

Standard W9 form: This is the most commonly used version of the form, which collects basic personal information and the recipient's TIN.

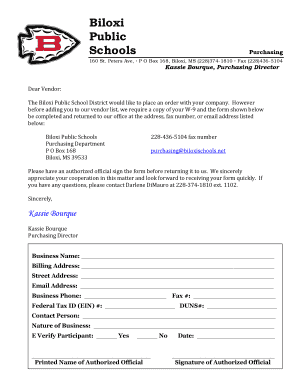

Specific-purpose W9 form: This version includes additional fields to gather specific information required for certain types of payments or reporting.

How to complete W9 request

Completing a W9 request is a straightforward process. Here's how you can do it:

01

Fill out all the required fields on the form accurately.

02

Provide your full legal name and TIN as it appears on your tax documents.

03

Sign and date the form to certify the accuracy of the information provided.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out W9 request

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I get my W9?

Where do I get W9 form? W9 forms are provided for free by the Internal Revenue Service. To make sure that you receive an up-to-date form, get yours directly from IRS.gov.

Who is exempt from providing a W9?

To qualify as exempt for W-9 purposes, the payee must be one of the following: Any IRA, an organization exempt from tax per section 501(a), or a custodial account per section 403(b)(7) if said account meets the criteria of section 401(f)(2) Corporation.

How much can you pay without W9?

When do I need to request a Form W-9? As a small business owner, it is important to collect a W-9 for any person or entity you pay more than $600 in a tax year. You will use the information provided to you on the W-9 to complete Form 1099-NEC, Nonemployee Compensation, or Form 1099-MISC, Miscellaneous Income.

Why would someone request a W9?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.

What happens if you don't provide a W9?

Penalties could be anywhere from $50 to $270 for every missing form. If you are a contractor, vendor, or payee of a business then failing to fill out a W-9 form may attract IRS penalties.

What is a W9 request?

Form W-9 is an IRS tax form that requests information for an individual defined as a U.S. citizen or a person defined as a resident alien. The information is used to fill out Form 1099 and is used for independent contractors, freelancers, or unrelated vendors. not employees.