Donation Receipt Template

What is Donation receipt template?

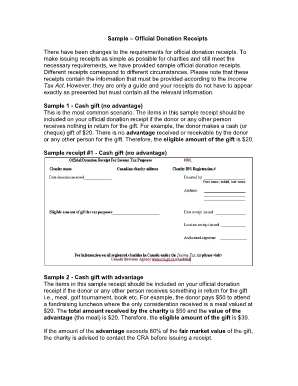

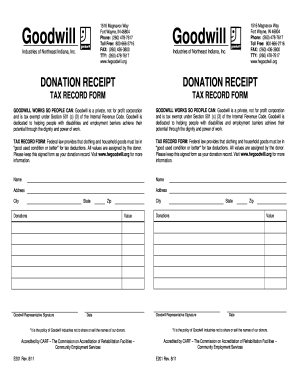

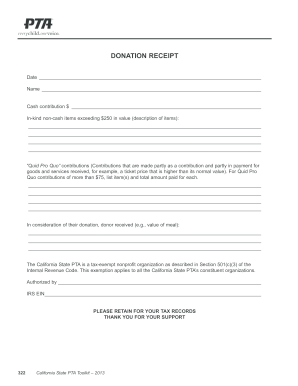

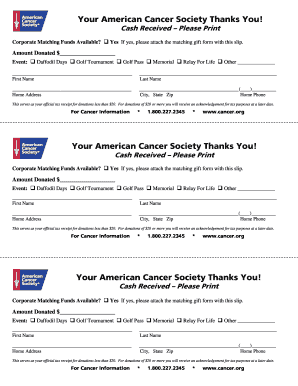

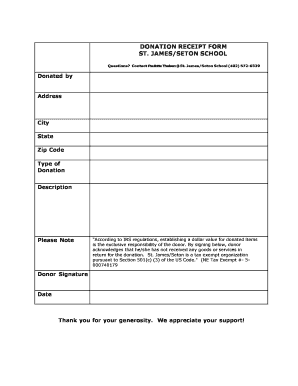

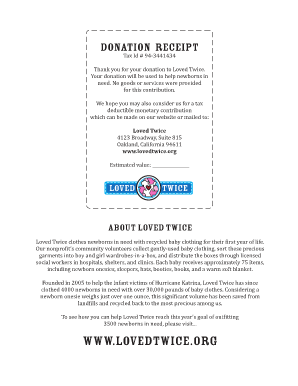

A Donation receipt template is a document used by non-profit organizations to acknowledge donations made by individuals or businesses. It serves as a record of the donation for both the donor and the organization receiving the donation.

What are the types of Donation receipt template?

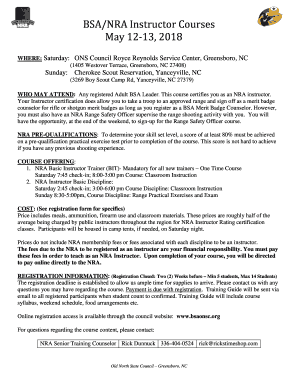

There are several types of Donation receipt templates that non-profit organizations can use to acknowledge different types of donations. Some common types include:

Cash donation receipt template

In-kind donation receipt template

Sponsorship donation receipt template

One-time donation receipt template

Recurring donation receipt template

How to complete Donation receipt template

Completing a Donation receipt template is easy and straightforward. Here are some steps to help you fill out the template:

01

Enter the donor's name and contact information

02

Specify the donation amount or value of the donation

03

Include the date of the donation

04

Describe the purpose of the donation

05

Provide a statement of gratitude for the donation

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Donation receipt template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write a receipt for a donation?

You should always have the following information on your donation receipts: Name of the organization. Donor's name. Recorded date of the donation. Amount of cash contribution or fair market value of in-kind goods and services. Organization's 501(c)(3) status.

How do you write a donation letter for tax purposes?

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

What is a donation receipt letter for tax purposes?

Again, the IRS requires that a tax-exempt organization send a formal acknowledgment letter for any donation that is more than $250. The donor will use this letter as proof of his or her donation to claim a tax deduction.

How do I document a donation?

Generally, to properly document a cash donation, the record of your donation must show the: Name of the charity. Date of the donation. Amount of the donation.

What is a donation receipt letter?

A donation receipt is a written acknowledgment from a nonprofit organization for any monetary or non-monetary contributions made by a donor.

What is proof of charitable donations?

Because charitable contributions are often tax deductible, taxpayers must furnish proof in the form of an official dated receipt from the receiving organization or some other official record of the transaction.