Loan Estimate Form Templates - Page 2

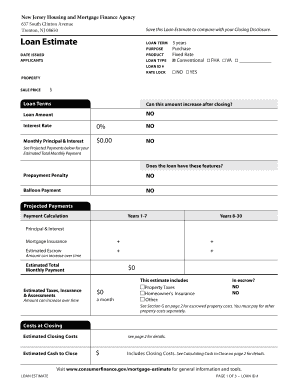

What are Loan Estimate Form Templates?

Loan Estimate Form Templates are standardized forms used by lenders to provide potential borrowers with detailed information about the terms of a loan. These forms help borrowers understand the costs and terms associated with a loan before making a final decision.

What are the types of Loan Estimate Form Templates?

There are several types of Loan Estimate Form Templates that cater to different types of loans. Some common types include: Conventional Loan Estimate Form, FHA Loan Estimate Form, VA Loan Estimate Form, Adjustable-Rate Loan Estimate Form, Fixed-Rate Loan Estimate Form.

How to complete Loan Estimate Form Templates

Completing Loan Estimate Form Templates is simple and straightforward. Follow these steps to ensure accuracy and completeness:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.