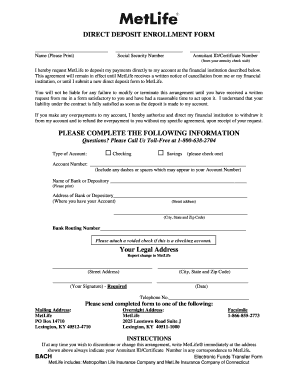

Direct Deposit Change Form - Page 2

What is Direct deposit change form?

The Direct deposit change form is a document used to update banking information for direct deposit payments. This form is typically used by companies or organizations to ensure that employees or individuals receive their payments directly into the correct bank account.

What are the types of Direct deposit change form?

There are primarily two types of Direct deposit change forms: Internal and External. Internal forms are used within an organization by employees to update their direct deposit information with the company. External forms are used by individuals or vendors to provide their banking details to an organization for payment purposes.

How to complete Direct deposit change form

Completing a Direct deposit change form is a simple process that can be done in a few easy steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.